The Unbreakable Farmer: Breaking down mental health stigma in the bush

23 August 2022

Yara Australia to sell its Yara Nipro liquid fertiliser business to Incitec Pivot Fertilisers

29 August 2022Food Supply Chain Alliance calls for action on labour shortages ahead of Jobs and Skills Summit

26 August 2022

AUSVEG has joined other food supply chain associations, as members of the Food Supply Chain Alliance, to highlight the critical shortage of labour across the food supply chain, totalling over 170,000 workers, which will ultimately impact food availability and prices.

Australia’s $15 billion horticulture industry is currently experiencing a labour shortage of approximately 10,000 individual workers, which equates to many more roles as workers follow the harvest trail for seasonal work. The demand for workers increases significantly from winter to summer as production ramps up leading into the summer harvest period, putting further strain on growers.

The economic cost for fruit and vegetable growers of the ongoing labour shortage is not just the opportunity cost for the lost production that could be planted and harvested, but also the longer-term impact for fruit and vegetable growers who must reduce investment in areas that would increase their production efficiency and profitability for future seasons.

Tackling the price of food and issues with food availability can be achieved by finding viable, practical solutions to the chronic labour shortages in the food supply chain.

There is a significant backlog of visa applications that must be processed as a priority to ensure that those who are willing and wanting to come into Australia to work can do so.

Consideration must also be given to alternative labour solutions to help those who want to work to do so, including simplifying Temporary Visa conditions to allow temporary visa holders to work longer hours, extend their visa and apply for permanent residency.

To learn more about the impacts of these labour shortages across the supply chain:

- Read Charlie Peel’s article in The Australian >> Floundering food industry needs more hands on deck to ensure supply chain (theaustralian.com.au)

- Read the Food Supply Chain Alliance media release >> Food Sector Labour Shortages MR.docx (ausveg.com.au)

Jobs and Skills Summit

AUSVEG has been working with political representatives and industry partners to ensure that the vegetable industry’s concerns are raised at the Federal Government’s upcoming Jobs and Skills Summit. While the NFF is the only agriculture representative invited to attend the summit, AUSVEG has provided input to ministerial roundtables with the agriculture and trade ministers to ensure that pertinent issues affecting vegetable growers are raised and considered by the Federal Government.

The vegetable industry’s needs are unique compared with other industries, and solutions to its problems must be tailored to the specific needs of the industry. Major issues raised by AUSVEG include:

- Urgent need for a plan around regional accommodation to ensure that workers are able to live and work near farming regions.

- Processing the significant backlog of visa applications to ensure that those who are willing and wanting to come into Australia to work can do so.

- Consider alternative labour solutions to help those who want to work to do so, including simplifying Temporary Visa conditions to allow temporary visa holders to work longer hours, extend their visa and apply for permanent residency.

AUSVEG has joined other food supply chain associations, as members of the Food Supply Chain Alliance, to highlight the critical shortage of labour across the food supply chain, totalling over 170k, which will ultimately impact food availability and prices. The group’s efforts have been widely reported across regional and national print, radio, TV and online news, and have been echoed by politicians and other industry representatives in the leadup to the Jobs and Skills Summit.

Tackling the price of food and issues with food availability can be achieved by finding viable, practical solutions to the chronic labour shortages in the food supply chain.

Growers need to receive a fair price for their produce

For years growers have been pushed to reduce the cost of producing food. With increasing costs of production, growers are finding it increasingly difficult to break even and can barely cover production costs.

The current retail price of vegetables does not reflect the increased costs of production required to plant, grow, and pack fresh produce, including but not limited to chemicals, fertilisers, fuel, energy, labour, packaging, and freight.

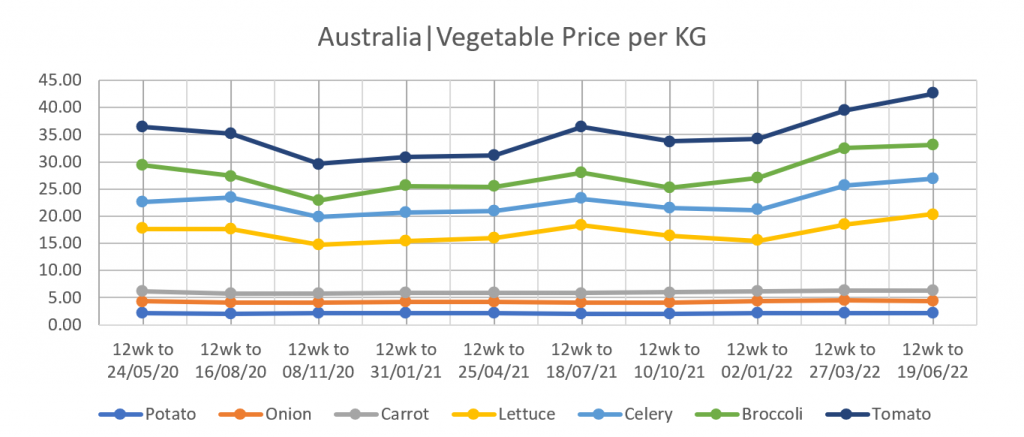

In the graph below you can see the average retail price for vegetables from the last two years. Despite the challenges of the pandemic, the prices have remained relatively stable.

*Hort Innovation Australia calculation based in part on data reported by NielsenIQ through its Homescan Service for the fresh vegetables category to 24th April 2022, for the Total Australia market, according to the NielsenIQ standard product hierarchy. Copyright © 2022, Nielsen Consumer LLC

| Core Vegetable Prices | May 2020 price ($/kg) | June 2022 price ($/kg) | Percentage change |

| Revenue | |||

| Potatoes | AUD$2.18 | AUD$2.19 | 0.45% |

| Onions | AUD$2.12 | AUD$2.20 | 3.77% |

| Carrots | AUD$1.86 | AUD$1.89 | 1.61% |

| Lettuce | AUD$11.54 | AUD$14.11 | 22.27% |

| Celery | AUD$4.94 | AUD$6.49 | 31.37% |

| Broccoli | AUD$6.69 | AUD$6.31 | -5.68% |

| Tomato | AUD$7.04 | AUD$9.39 | 33.38% |

| Average of all vegetables | 11.4% |

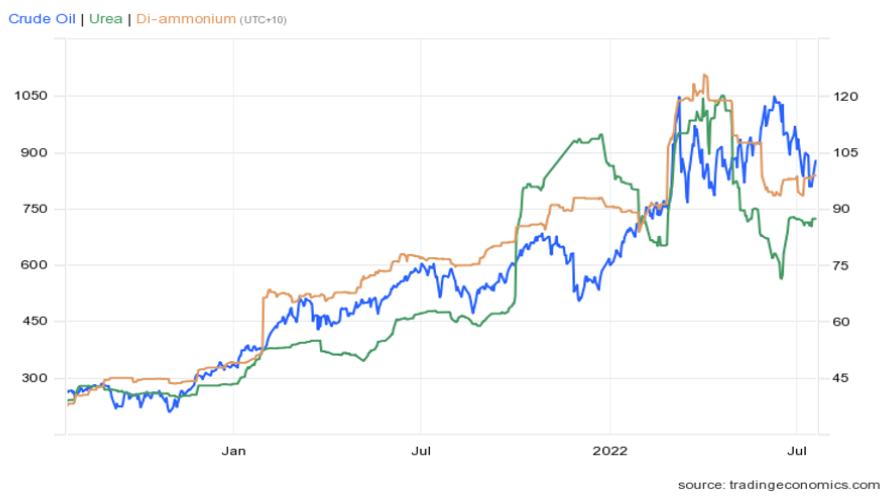

Now, compare this to the below graph of the prices of key inputs such as crude oil (diesel), urea, and DAP.

As you can see, inputs have risen significantly, for just these core inputs, they have risen on average 216% since May 2020.

| Cost | May 2020 | June 2022 | Percentage increase |

| Urea | AUD$310.25/mt | AUD$981.34/mt | 216.3% |

| DAP | AUD$404.13/mt | AUD$1110/mt | 174.7% |

| Crude Oil | AUD$46.68/bbl | AUD$166.12/bbl | 255.9% |

| Average | 215.6% |

Retail prices for vegetables have increased by an average of 11.4% while growers are shouldering the burden of a 215% increase in some critical farm inputs, not to mention battling adverse weather and worker shortages at the same time.

Growers cannot be expected to continue to shoulder this increase. All buyers of fresh produce, including retailers, wholesalers, processors and consumers must expect to increase the prices they pay to growers or growers may be forced to exit the industry.

Freight

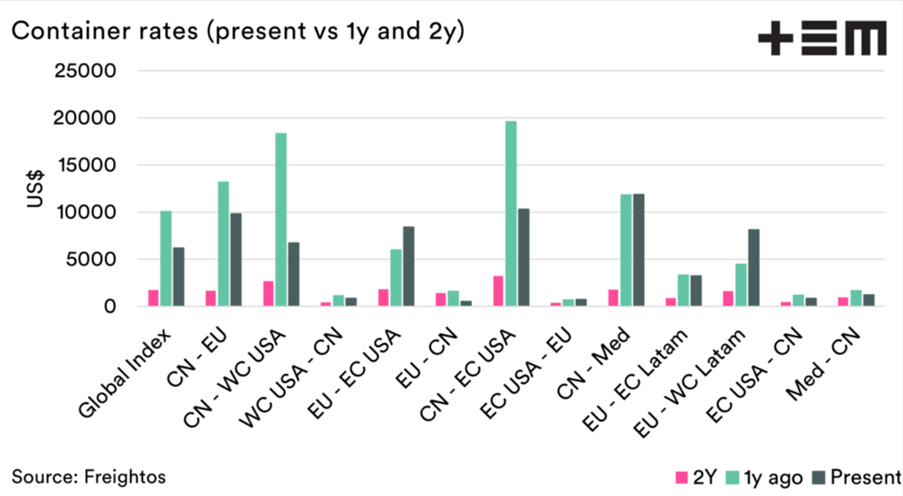

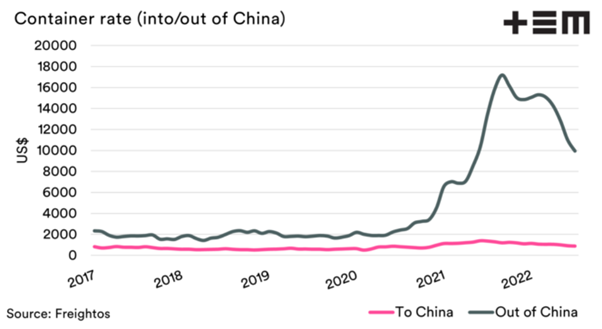

Enormous freight prices over the last two years have meant that it is more costly to export produce. However, the prices have reduced from the spike we saw last year. This is not to say that the prices are at pre-COVID levels, but they have reduced none the less.

Looking at the prices of containers out of China, there has also been a significant decrease in price. The price of freight coming out of China will directly impact the price of fertilisers and other chemicals from China used on Australian farms.

Comparison to other commodities

The prices of other commodities have increased an average of 44.4% from January 2020 to June 2022. Each have faced their own price increases and challenges, but the price on supermarket shelves has also gone up considerably.

| Commodity | Jan 2020 | June 2022 | Percentage change |

| Vegetables (all) | AUD$4.98/kg | AUD$5.55/kg | 11.4% |

| Wheat | USD$569/bu | USD$804.7/bu | 41.4% |

| Canola | CAD$478.3/t | CAD$833.50/t | 74.3% |

| Cattle (EYCI) | 477c/kg cwt | 964.60c/kg cwt | 102.2% |

| Trade Lamb* | 702c/kg cwt | 749.5c/kg | 6.8% |

| Milk | USD$17/cwt | USD$22.54/cwt | 32.6% |

| Cotton | USD$70.3/lbs | USD$100.2/lbs | 42.5% |

| Average | 44.4% |

*(Trade Lamb experienced extraordinarily high prices throughout the pandemic, up to 951.02c/kg)

Historic data – 2013 to 2021

When we look at the historic price of vegetables, it is clear that the farm-gate value of produce is relatively flat.

Take potatoes as an example. Potatoes are an Aussie favourite – they are versatile, easy to prepare, and great for your health and well-being. However, according to Hort Stats (Hort Innovation | Australian Horticulture Statistics Handbook 2020/21), over a nine-year period from 2013 to 2021, the dollar per kilo value of fresh supply (i.e. produce that goes to retail and food service) of potatoes (total volume of fresh supply over the value), potatoes have only increased by 5.4%, nowhere near keeping up with the costs of inflation or the increases in production costs.

While there are many factors that influence this, including the improved production practices of potato growers, this is concerning for the long-term viability of many businesses.

Consumers are understandably concerned that their prices are increasing, but they should also be aware and concerned that the prices growers are receiving has hardly increased in the last decade.

The outlook for other commodities for fresh supply is also similar:

| Vegetables $/kg | 2013 | 2021 | % Change |

| Potatoes | $1.11/kg | $1.17/kg | 5.4% |

| Onions | $0.75/kg | $1.02/kg | 36% |

| Carrots | $0.88/kg | $0.98/kg | 11.36% |

| Head Lettuce | $1.29/kg | $1.45/kg | 12.4% |

| Celery | $0.94/kg | $1.06/kg | 12.8% |

| Broccoli/ baby broccoli | $3.07/kg | $3.96/kg | 29% |

| Tomatoes | $3.00/kg | $2.63/kg | -12.3% |

| All Vegetables | $1.99/kg | $2.31/kg | 16.08% |

Hort Innovation | Australian Horticulture Statistics Handbook 2020/21

AUSVEG Cost of Production survey results

AUSVEG has been surveying growers to gain anonymised data around costs of production, expected plantings, and confidence in the industry’s outlook over the next 12 months. High level results of the survey across the vegetable sector include:

- Cost of production has increased by an average of 25% for businesses in the vegetable sector.

- More than three quarters of businesses have indicated that their farm business margins have decreased in the last 12 months.

- More than two-thirds of businesses are not confident over the outlook for the next 12 months, and no business surveyed indicated that they were very or extremely confident.

These results are worrying. Growers cannot be expected to continue to shoulder this increase. All buyers of fresh produce, including retailers, wholesalers, processors and consumers must increase the prices they pay to growers.