Final report: VegNET 2.0 – NT

23 February 2022

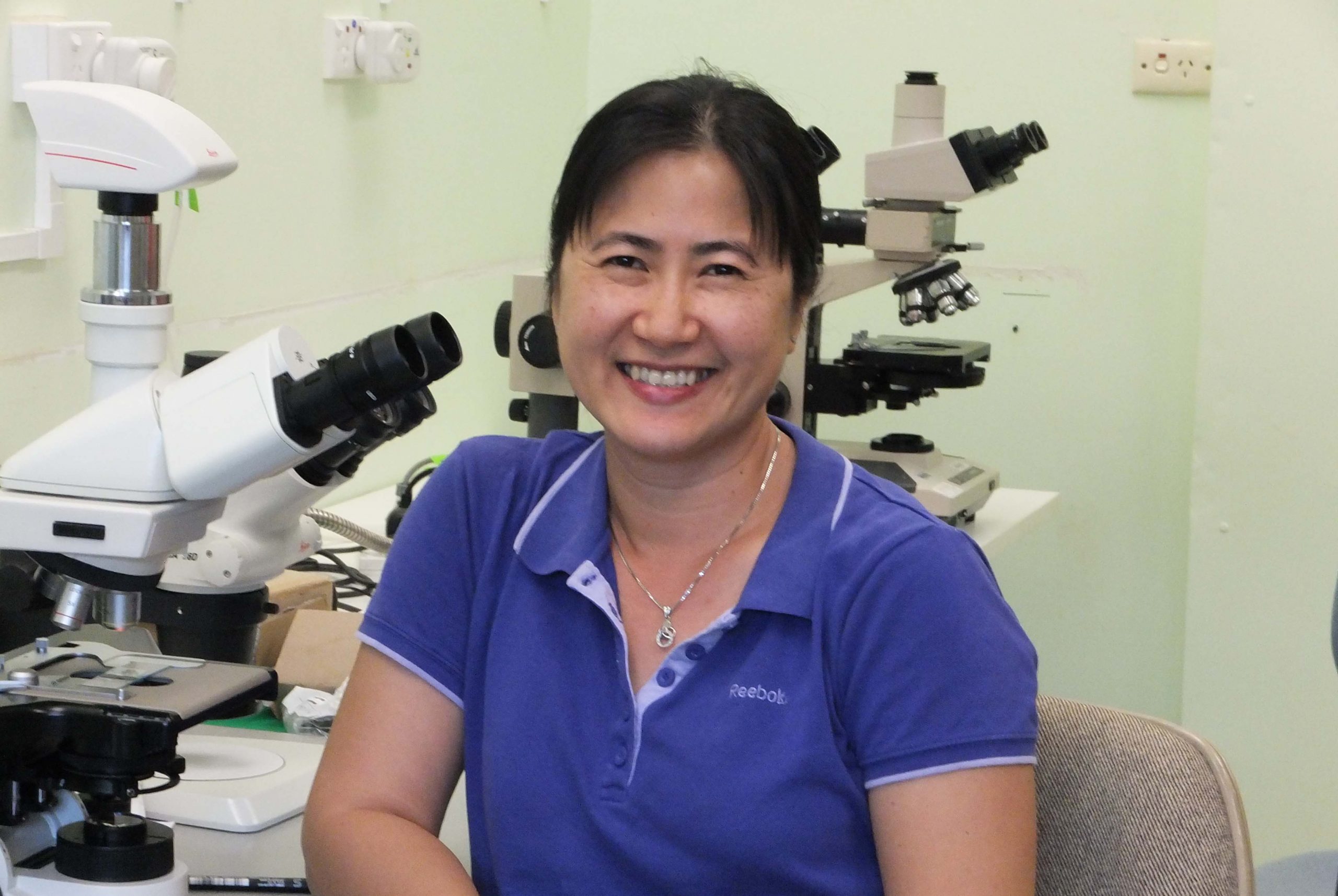

Meet Dr Lucy Tran-Nguyen: The Top End ‘ologist’

28 February 2022With cumulating pressure from rising farm input costs, labour shortages, operational constraints, international shipping backlogs and expensive freight costs, Australian vegetable grower-exporters continue to ship fresh vegetables to international markets. AUSVEG International Trade Specialist Andrea Lin reports.

Australian vegetable export performance overview – 2021

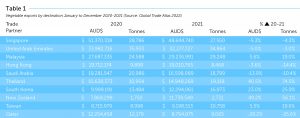

Total vegetable exports have seen a modest decline compared to the same period in 2020. Based on data from the Global Trade Atlas, there was a 4.5 per cent decrease in export value, from $263 million to $251 million and total export volume grew by 2.6 per cent from 216,678 tonnes to 222,350 tonnes. The top four markets for fresh vegetable exports were Singapore, the United Arab Emirates (UAE), Malaysia and Hong Kong. There was strong growth recorded for the ASEAN region, South Korea, New Zealand, and Taiwan in 2021 (refer to Table 1).

Singapore continued to be the top Australian fresh vegetable export market, although it recorded a slight decline in both export value and volume in 2021. The export value dropped by 5.3 per cent from January to December 2021, from $51 million to $48 million; export volume also decreased by 4.3 per cent from 28,786 tonnes to 27,550 tonnes. The UAE fresh vegetable export market fell by five per cent in value and three per cent in volume. Malaysia recorded a 5.7 per cent rise in export value and 1.9 per cent increase in tonnage.

Vegetable export by crop – 2021

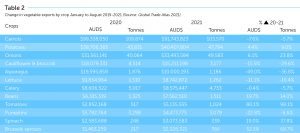

Root vegetables such as carrots, potatoes and onions remained the top three export crops for the Australian vegetable industry (refer to Table 2). Perishable vegetable export crops that are heavily reliant on air freight – notably asparagus – saw a substantial drop in trade for the 2021 season.

Carrots

Carrot export value saw a 7.6 per cent decline from $93 million to $92 million and a 5.7 per cent reduction in export volume, with 6,304 tonnes less shipped in 2021. There was an overall decline in exports to international carrot markets apart from Malaysia, which recorded a 9.6 per cent increase in imports of Australian carrots in value from $13 million to $14.6 million, and 15.7 per cent growth in export volume, contributing an additional 3,000 tonnes to its carrot imports (refer to Table 3).

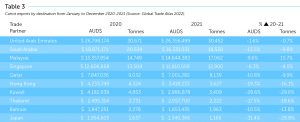

Potatoes

Potato export value increased by 4.4 per cent, adding $1.7 million to Australia’s overall potato exports, along with a nine per cent increase in volume by 3,900 tonnes. These were largely driven by potato exports to Thailand which recorded an increase of 145 per cent in export value from $1.3 million to $3 million and more than double in export volume from 1,092 tonnes to 3,470 tonnes.

The Philippines was another strong export destination for Australian potato exports, recording a continued increase in export value and volume over the last three years, with an increase of 16 per cent in export value from $4.3 million to $5 million in 2021 (refer to Table 4).

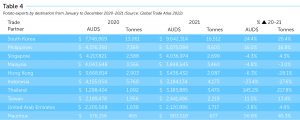

Onions

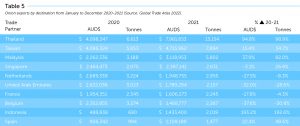

Onions export value has improved by 6 per cent from $31.5 million to $33.5 million and recorded a 23 per cent increase in volume from 40,064 tonnes to 49,583 tonnes. Thailand, Taiwan and Malaysia were the top three trade partners for Australian onion exports. Thailand has recorded a significant increase in export value by 94.8 per cent, from $4 million to nearly $8 million; export volume has grown by 98.9 per cent from 6,613 tonnes to 13,154 tonnes.

Malaysia has taken over Belgium as the third largest onion export destination in 2021, recording a 38 per cent increase in export value from $2.2 million to $3.1 million and an 82 per cent increase in volume from 3,188 tonnes to 5,802 tonnes (refer to Table 5).

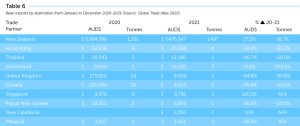

Beans

Bean exports continue to be strong, recording a 20 per cent increase in value from $6.3 million to $7.5 million in 2021. New Zealand remained the top bean export destination with a 27.5 per cent increase in export value from $5.9 million to $7.5 million (refer to Table 6).

Export outlook for 2022

The impact and disruptions from COVID-19 on global supply chains and logistics are likely to remain as significant challenges for exporters in Australia and around the world well into 2022.

While export demand is reasonably buoyant, and customer enquiries for fresh produce orders continue, indications from airlines and shipping lines is that freight capacity and disruptions are likely to be a feature of the business environment for most of this year. It is unlikely there will be much pricing relief to access air and sea freight out of Australia.

Despite the difficult trading conditions, Australian vegetable grower-exporters have demonstrated strong resilience throughout the pandemic to continue to service export markets and customers, and the efforts of these businesses to supply high quality Australian vegetables to international consumers should be applauded.

AUSVEG is hopeful that 2022 will see opportunities for exporters to travel back into international markets to reconnect with customers and begin rebuilding relationships face-to-face, to begin the process of regaining market share and identifying new export opportunities.

Find out more

Growers interested in participating in export events or discussing export opportunities can contact the AUSVEG Export Development team on 03 9882 0277 or email export@ausveg.com.au.