Australian vegetable exports continue despite ongoing challenges

Throughout 2021, Australian vegetable grower-exporters have demonstrated resilience and hard work to ensure high-quality vegetables continue to make their way onto consumer tables around the world. This is despite rising freight costs, a rapid increase in farm input costs, difficulties with international shipping as well as labour shortages. AUSVEG International Trade Specialist Andrea Lin reports.

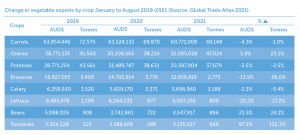

Vegetable trade highlights from January to August 2021

The first eight months of 2021 has seen a decline of fresh vegetable export value by 0.9 per cent (AUD$1.5million; M) to AUD$171.5M compared to January to August 2020.

As a further reference of continued vegetable export performance, the pre-COVID trade value was AUD$186.9M during the same eight-month period in 2019. Despite the decline in export value, total export volume has bounced back slightly by 4.3 per cent (6,907 tonnes) to 167,102 tonnes in 2021. Against the pre-pandemic period of January to August 2019, which saw total vegetable export volume of 178,852 tonnes, this year the overall export volume has decreased by 11,750 tonnes in comparison.

ASEAN and the Middle East remain as the main Australian fresh vegetable export destinations. Malaysia, Thailand, South Korea, New Zealand, and Taiwan have recorded strong growth in this period.

Malaysia

Fresh Australian vegetable exports to Malaysia recorded an increase of 7.1 per cent in value from AUD$18.7M to AUD$20M, and an increase of 23.8 per cent in volume from 17,340 tonnes to 21,471 tonnes.

The increase was primarily driven by strong imports of carrots, onions, and spinach. Carrot exports to Malaysia rose by 8.6 per cent in value from AUD$8.7M to AUD$9.5M and increased by 18.7 per cent in volume from 9,543 tonnes to 11,323 tonnes.

Onion export value to Malaysia grew by 40.4 per cent from AUD$2.1M to AUD$3M and export volume improved by 85 per cent from 3,046 tonnes to 5,639 tonnes. Spinach export value to Malaysia improved by 70 per cent from AUD$233,719 to AUD$397,612 contributing an additional 29 tonnes of spinach landing in Malaysia.

These are encouraging signs as Malaysians continue to favour Australian fresh vegetables above other international competitors.

Thailand

Despite the global supply chain disruptions and challenges to land fresh vegetables in Thailand, Australian vegetable exports increased by 39 per cent from AUD$8.4M to AUD$11.6M, with export volume climbing by 66.7 per cent from 9,209 tonnes to 15,351 tonnes.

The major driver of this increase was the increased imports of onions, potatoes and asparagus. Onion exports to Thailand have doubled in export value from AUD$3.7M to AUD$7.5M and in volume from 6,034 tonnes to 12,170 tonnes.

Potato exports to Thailand have recorded a significant 160 per cent increase in value from AUD$790,584 to AUD$2.1M and export volume jumped by 136 per cent from 739 tonnes to 1,744 tonnes, aided by the recently changed zero per cent tariff for Australian potatoes entering Thailand under the Thailand-Australia Free Trade Agreement.

Asparagus export value to Thailand also grew by three times from AUD$3,128 to AUD$14,605, from about one tonne in total exports.

New Zealand

Overall Australian vegetable exports to New Zealand have increased by 49 per cent in value from AUD$5.3M to AUD$7.9M, with an additional 100 tonnes of fresh vegetables being exported to our close neighbour.

Bean exports to New Zealand grew by 25 per cent in value from AUD$3.6M to AUD$4.5M. It also saw a growth of 26 per cent in volume from 701 tonnes to 885 tonnes, almost matching the 2019 result for bean exports to New Zealand.

Tomato exports to New Zealand also increased, recording AUD$669,590 in export value for 198 tonnes which was a strong improvement on AUD$53,233 and 21 tonnes in 2020.

Outlook

With a number of key trading partners starting to ease COVID restrictions and begin the journey towards a post-pandemic normal, global supply chain disruptions remain as huge challenges for producers around the world.

Continually rising freight costs, limited availability in freight capacity and port congestion remain unresolved, and Australian vegetable growers are now faced with compounding pressure from a rapid surge in farm input costs.

Fertiliser, fuel, cardboard and packaging prices have skyrocketed over recent months – some to record highs. These are additional pressures facing growers and exporters on top of the already difficult year with growers already battling to secure harvest labour to continue production.

There are various drivers behind the surge in some farm inputs. Fertiliser supply is being impacted by rising gas prices in Europe and logistical issues where shipping companies that transport fertilizer are also facing labour shortages and price increases, adding to costs. Fertiliser plants in Europe have been temporarily closed due to high gas prices leading to the uncertainty over European fertilizer supplies.

On a more positive note – with the Federal Government beginning to relax international border restrictions and commercial airlines rapidly recommencing passenger flights into key destinations – 2022 will bring opportunities for exporters to travel back into export markets to reconnect with customers and begin rebuilding relationships face-to-face. This change is happening quicker than some were forecasting, and many exporters will welcome the opportunity to recommence customer facing activities in the near term.

Find out more

Growers interested in identifying export events or discussing export opportunities can contact the AUSVEG Export Development team on 03 9882 0277 or email export@ausveg.com.au.