Powerful rotational partner boosts chewing pest control

3 October 2022

AUSVEG visits the West

11 October 2022AUSVEG Advocacy Activities – overview

AUSVEG has been regularly engaging with different areas of the horticulture sector and involved in a wide range of activities that are aimed to help growers in the short-, medium- and long-term to remain productive, profitable and competitive.

Government/Industry/Unions Tripartite Working Group

- AUSVEG has been engaging with members of the horticulture sector, including the National Farmers Federation Horticulture Council, to understand more about the Government/Industry/Unions Tripartite Working Group, which was formed as a result of the Jobs and Skills Summit in September.While the composition of the Working Group is yet to be made public, its remit is to focus on innovative solutions to agricultural workforce issues including to better skill, attract, retain and protect workers in the agriculture and processing sector.

Beginning in October, the Working Group will convene monthly for a period of 12 months, to inform the Government’s forthcoming Employment White Paper. AUSVEG will provide further updates to industry when more information comes to light.

Food Supply Chain Alliance

- AUSVEG remains an active member of the Food Supply Chain Alliance, which also includes the NFF, Independent Food Distributors Australia, the Australian Meat Industry Council, Seafood Industry Australia, Master Grocers Australia, Restaurant and Catering Industry Association and the Australian Association of Convenience Stores.The Alliance has been active in the media highlighting the 172k worker shortage across the food supply chain sector, and is collaborating on ways to further address the issue to government and policy makers. The two press releases produced by the Alliance are below.

Fruit & Vegetable Consortium

- AUSVEG, as a founding member of the Fruit & Vegetable Consortium, was recently involved in the development of a report that highlights the issues regarding vegetable consumption in Australia, which have deteriorated further as a result of the COVID-19 pandemic.The report, entitled ‘Shifting the dial on vegetable consumption — Rebuilding healthy families in a COVID-19 affected and disrupted Australia’, was prepared by KPMG and launched at an event in Melbourne on Wednesday 5 October. It includes recommendations to drive behavioural change, integrate the work of industry and government, and draws on powerful insights from consumers, growers and experts. Click here to read the report.

L-R: Emcee Alice Zaslavsky, Medibank Chief Medical Officer Dr Linda Swan, AUSVEG CEO Michael Coote, Fight Food Waste CRC and Stop Food Waste Australia CEO Dr Steven Lapidge, Nutrition Australia CEO Lucinda Hancock and VicHealth CEO Dr Sandro Demaio (not pictured CSIRO / Public Health Physician Specialist Dr Rob Grenfell)

- AUSVEG is continuing to work with growers and the supply chain on the critical issue of rising costs of production that are affecting every grower around Australia. Below is an overview of the latest data AUSVEG has obtained on the issue.

Food and Grocery Code of Conduct

- AUSVEG is continuing to work with industry on the Food and Grocery Code of Conduct, including preparations for a pending review into the Code that is expected to be announced this month. An overview of these activities, as well as an overview of the price negotiation process, is below.

Unpacking the Vegetable Industry – video series

AUSVEG’s video series Unpacking the Vegetable Industry launched last month looking at the vegetable supply chain. The latest video in the series is included in the update below.

Cost of Production and Supply Chain Update

Fertiliser

The issue of fertiliser shortages has continued to develop over recent months. The war between Russia and the Ukraine highlighted the impact of global events on our own industry and supply chain.

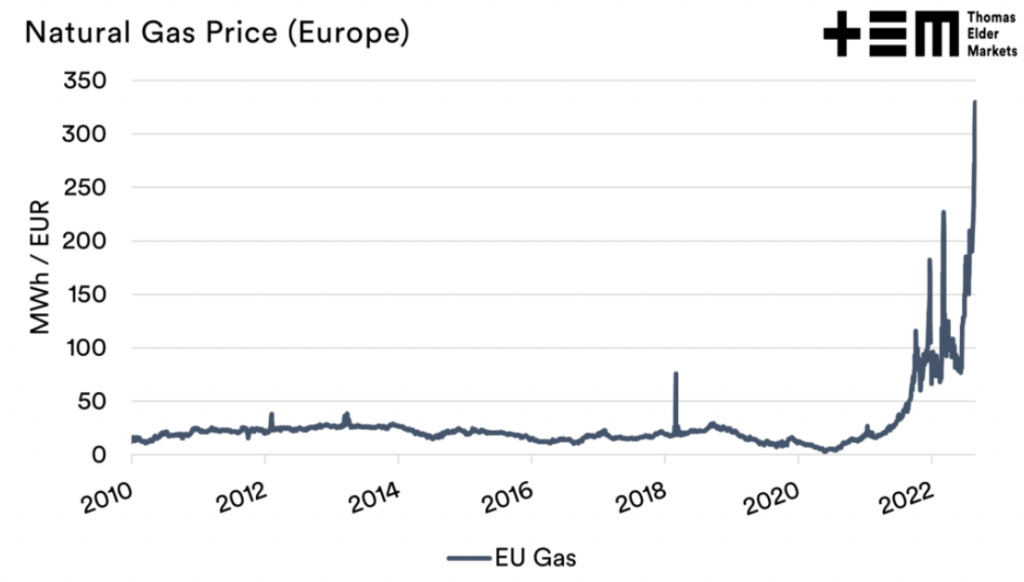

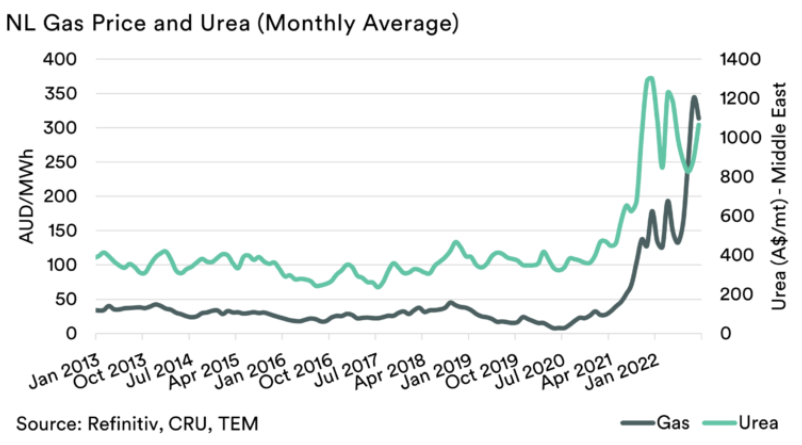

Russia is a big contributor to Europe’s gas supply, making up approximately 40 per cent of its natural gas supply last year. With the pending drop in supply, the gas price has hit record highs in Europe, which is coming into winter and fearing an energy crisis.

Natural gas is the main input into fertilisers, which has been reflected in the price of European fertiliser. The high cost has also led nearly three quarters of manufacturers to curtail production.

European production has reduced for the following:

- Ammonia: 50%

- Urea: 40%

- Nitrates: 34%

- UAN: 30%

The Middle East, United States and Northern Africa have indicated that they will increase their production to fill the shortfall, but this won’t quite be enough to fill the pending gaps.

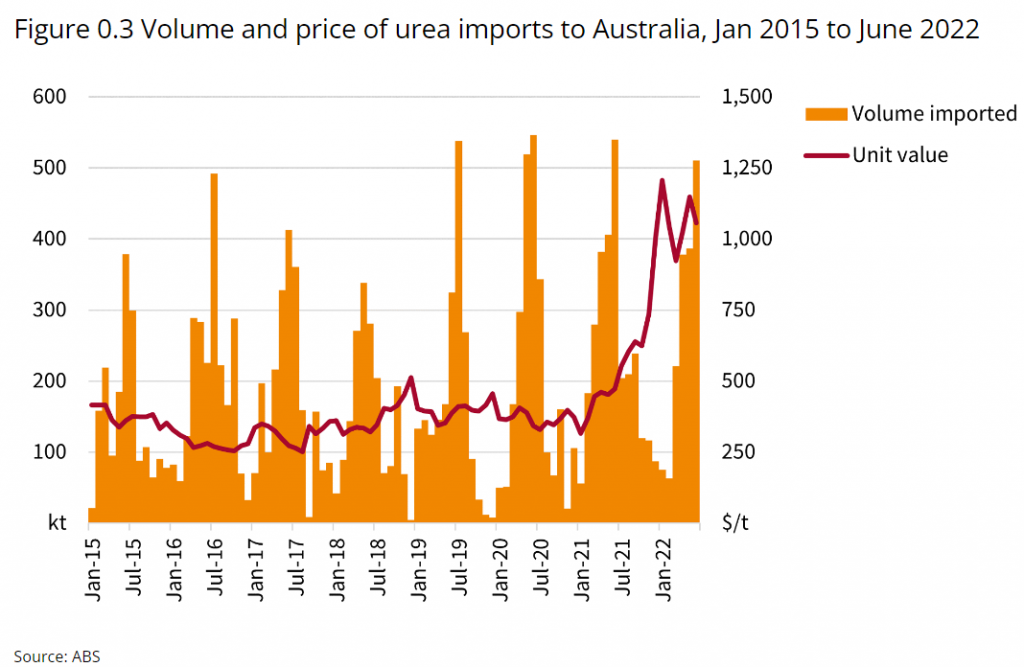

These high fertiliser prices are expected to stay well into 2023. However, data from the Australian Bureau of Agricultural and Research Economics and Science (ABARES) shows that despite higher prices, imports of Urea have remained relatively steady in the last 12 months (as shown in Figure 0.3).

This is a potential double-edged sword for growers as there should be sufficient supply for the 2022-2023 season, but prices will likely remain high.

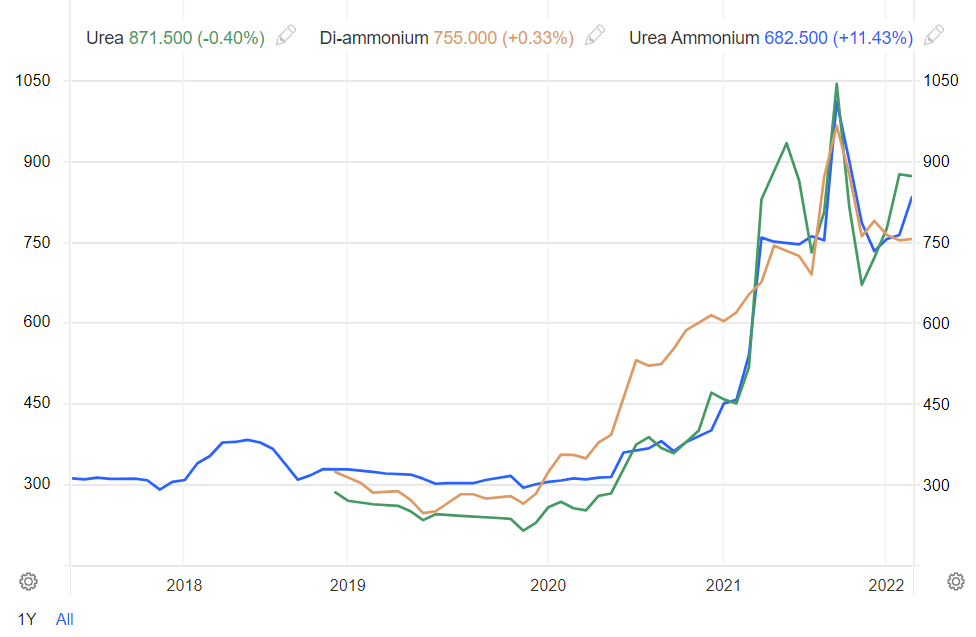

Energy prices are also impacting Di-ammonium (DAP) and Urea Ammonium fertiliers, as shown in the following graph.

Read more about the fertiliser prices below:

- Russia sanctions: How can the world cope without its oil and gas? – BBC News

- Market Morsel: Nervous about Fert? This won’t help. – Thomas Elder Markets

- Europe’s fertiliser shutdown as gas prices soar – ABC News

- Market Morsel: The gas price could bite your fertilizer bill. – Thomas Elder Markets

AdBlue and future supply

The Federal Government is looking to safeguard AdBlue, which is a critical ingredient in our supply chain. Last year, Australia was on the verge of a AdBlue shortage.

The Morrison Government gave $29.4 million in funding to Incitec Pivot’s urea and AdBlue factory in Brisbane. The company ramped up production to prevent the shortage; but now, as planned, Incitec Pivot will close its factory at the end of 2022.

In an effort to find a long-term solution the Federal Government is investing to find workable solutions to safeguard supplies of AdBlue.

Last week, Climate Change and Energy Minister Chris Bowen announced the government’s plan to build a five-week stockpile of Diesel Exhaust Fluid (DEF) (AdBlue) to protect Australia’s manufacturing and trucking industry. The stockpile will be established using $49.5 million in funding over four years.

Some funding will also go to domestic manufacturing projects, which will promote a longer-term solution for our industry.

The broader issue in that urea is also a key ingredient in agricultural fertiliser and chemicals, which are both critically linked to our nation’s food security.

See the media release from the Climate Change and Energy Minister here.

Export Update

Port Conditions

- High container rates and dwell periods are being reported at ports across the continent. This is due to labour shortages at ports and shortages across the inland transport industry (trucks, waterways, and warehouses).

US Ports

- Are experiencing extended waiting periods.

- On the west coast ports are suffering delays of 10-15 days.

- On the east coast ports are suffering delays of 12-24 days.

Industrial Action

- Further industrial action across the UK.

- US west coast negotiations are ongoing.

Sea freight

- Global schedule reliability continues to improve.

- The global container fleet is 12 per cent larger than 2019, yet due to congestion and unreliability of ocean freight there are still issues being experienced globally.

Delays

- Average delays decreased to 6.28 days globally in July 2022.

Cancellations

- Cancellations are causing further delays, with 97 sailings cancelled between 5 September and 9 October 2022. The delays will mean elevated prices but steady supply.

To read more about the supply chain issues sign up to the AusTrade newsletter and keep an eye out for their Export Supply Chain Snapshots.

Unpacking the Vegetable Industry – What are the biggest challenges?

AUSVEG’s video series Unpacking the Vegetable Industry launched last month looking at the vegetable supply chain. This week, AUSVEG Deputy Chair and Managing Director of Costal Hydroponics Belinda Frentz unpacks the major challenges currently facing the vegetable industry.

Food and Grocery Code

The Food and Grocery Code is a voluntary code prescribed under the Commonwealth Competition and Consumer Act 2010 (CCA).

The code was introduced to address harmful practices and behaviours in the grocery sector and minimise disputes between retailers and suppliers.

The code seeks to encourage improved standards of business conduct and monitor the relationship between suppliers and retailers/wholesalers. The code includes guidance on supply agreements, payments to and from suppliers, and other conduct such as price increases, funded promotions, and dispute resolution.

There are four retailers that are signatories to the Code – Coles, Woolworth, Aldi, and Metcash. The code requires signatories to collect information on their business conduct including the satisfaction of their suppliers, price increases requests, and complaints.

Each signatory has its own code arbiter who deals with complaints and issues. Any issues between code arbiters and suppliers can be elevated to the independent reviewer, Chris Leptos, who oversees conduct including the dispute resolution process of all signatories and suppliers. Each year the independent reviewer releases an Annual Report of business conduct for each of the signatories in relation to the code, as well as an amalgamated report for public view. The information is based on results from surveys sent to suppliers.

The Annual Report is important to identify emerging trends and systemic issues in the grocery supply chain.

The Food and Grocery Code is coming under review in October this year, with a specific focus on the dispute resolution process. AUSVEG is looking to build on its evidence about the grower dealings with retailers. If you would like to share any information, please contact AUSVEG Policy Officer, Chloe Betts at 03 9882 0277 or by email at chloe.betts@ausveg.com.au. This information will be strictly confidential.

How to negotiate a better price and elevate issues with the Food and Grocery Code of Conduct

The Food and Grocery Code of Conduct (FGCC) outlines a pathway for grocery suppliers to submit complaints and negotiate a better price. It is important that growers are aware of this pathway so they can ensure they have a fair opportunity to negotiate price and resolve issues. A brief overview of this process can be found below:

1. Ensure your grocery supply agreement with the retailer includes a mechanism to negotiate price on a regular basis

In this mechanism should be a 5-day timeframe for the retailer to conclude price increase negotiations from the day you inform the retailer of the price increase.

2. Submit a price increase request to the retailer

If the retailer rejects the price increase or you are unhappy with the outcome, you can elevate your issue to the Code Arbiter or straight to the independent reviewer.

| The Code Arbiters are individuals appointed by the retailers to investigate and resolve complaints.

The independent Reviewer oversees conduct including the dispute resolution process of all retailers and suppliers. |

Your complaint will be treated confidentially, and you can control when you want your identity (or the identity of your organisation) to be disclosed to the retailer. You can also be represented by a third party when undertaking this process.

3. Lodge your complaint with a Code Arbiter

When lodging your complaint, you must include the following details:

- Supplier dentification details.

- Contact details for the supplier.

- Details of the conduct giving rise to the complaint.

- The provision of the code you think is relevant to the complaint.

There is no cost to you as the supplier for using the Code Arbiter process.

The Code arbiter will conduct an investigation and provide a proposed remedy.

If you do not accept the proposed remedy, you can refer your complaint to the Independent Reviewer.

| You can also speak confidentially with the code arbiter to make an informal complaint. This does not require a written submission and can be used by the code arbiter in an aggregated and de-identified format to provide to the retailers of early signs of bad behaviour. You can remain anonymous. |

4. Refer your complaint to the Independent Reviewer

The independent reviewer will conduct an investigation and make recommendations to the Code Arbiter to reconsider your case if insufficient procedures were taken.

If the Independent Reviewer finds any breaches of the FGCC that have not been addressed by the Code Arbiter or retailer, he can refer the matter to the Australian Competition and Consumer Commission (ACCC) for potential enforcement action.

There is no cost to you as the supplier for this Independent Reviewer process.

5. Mediation and arbitration

Suppliers can also choose to take an alternative dispute resolution system. Provisions in the Code make it compulsory for the supermarkets/wholesaler to take part in mediation or arbitration in good faith.

Supplier can take their own legal action or lodge a complaint directly with the ACCC regarding breaches of the Code or other breaches in the Competition and Consumer Act 2010.

For more information on this process please refer to the ACCC website, the Food and Grocery Code Legislation, the FGCC independent reviewer website or contact Policy Officer Chloe Betts at chloe.betts@ausveg.com.au.