Capsicum: The feel-good crunch

Hort Innovation has worked with global information and measurement company, Nielsen, to bring growers the largest series of insights into market performance and shopping behaviour yet. The latest update is on the Australian capsicum industry. Nielsen Associate Director Melanie Norris reports.

One of the heroes of the Mediterranean diet, capsicum is highly versatile vegetable. It can be stuffed, roasted, stir-fried or simply eaten raw as a snack. Capsicum is purchased by 77 per cent of Australian households and enjoys year-round sales, peaking during the height of summer.

Australians eat more capsicum than their American counterparts. Just 44 per cent of US households purchase capsicum in a quarterly period compared to 59 per cent of Australian households.

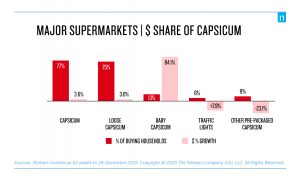

Over the past year, capsicum volume sales in Australia have grown steadily (2.7 per cent), while many competitor vegetables have seen decline. The average price of capsicum has remained relatively stable with an increase of just 0.9 per cent over the past 12 months. However, this was not the case across the major supermarket chains, with these retailers increasing the price per kg of capsicums by 5.8 per cent, and experiencing a 2.2 per cent volume decline and 3.5 per cent dollar growth for this channel. Major supermarkets sell over two-thirds of the dollar sales of capsicum and are highly influential on the overall trends we see in the market.

Contrary to the trend in major supermarkets, greengrocers, along with markets and other independent supermarkets, enjoyed strong volume (11.4 per cent) and dollar growth (3.8 per cent) for capsicums, indicating a decrease in average price (6.8 per cent).

Differentiating capsicum

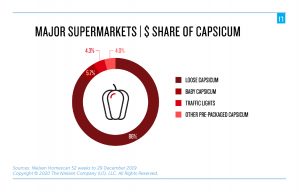

Pre-packed vegetables offer consumers a convenient, easy-to-use option. With its brightly coloured hue, pre-packed capsicum stands out in store with several offers including traffic lights, baby capsicum and other multipacks. In major supermarkets, pre-packed capsicum represents 14 per cent of all dollar sales for capsicum.

Currently, baby capsicum is the most popular of the capsicum prepacks. This segment grew 84.1 per cent in dollar sales over the past year and increased the number of buying households by 403,000. Baby capsicum is finding favour with couples and singles aged 35+ years, probably due to its single-serve nature.

There is further opportunity to increase the reach of baby capsicum to include more families; for example, baby capsicum would make a tasty addition to the school lunchbox. Currently the percentage of buying households is relatively low (13 per cent) and shoppers only have an eight per cent spontaneous awareness of the baby capsicum product.

In-store sampling may help to drive further trial.

Driving capsicum sales

Over three-quarters of Australian households purchased capsicum last year; but there is still room to increase this number and encourage existing shoppers to purchase more.

Wastage is cited as the number one barrier to purchasing more capsicum. Wastage is also the second most significant factor after ‘dislike’ for non-buyers. Recipe ideas featuring capsicum in various meal occasions, as well as preserving techniques and education in how to properly store capsicums to maintain freshness, may assist in boosting sales.

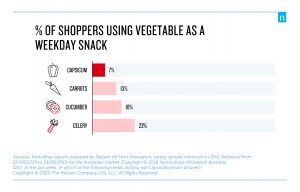

Another way to potentially increase sales is to highlight capsicum’s versatility as a snack. Capsicum rates fourth of all the vegetables surveyed as a regular weekday snack and there is opportunity to further develop this market by promoting it alongside tasty snacking partners, such as hummus and cheese.

With its eye-catching colour and plentiful supply, capsicum has cemented its place as a staple of the Australian table. Encouraging the use of capsicum with recipe ideas in a variety of meals and eating occasions may assist in removing wastage as a perceived barrier to purchasing more. While most sales in capsicum are loose, promoting interest in new formats such as baby capsicum, which is proving popular with older singles and couples, could drive interest and sales from other demographics as awareness grows.

Find out more

Please contact Melanie Norris at melanie.norris@nielsen.com.

These data and insights were produced independently by Nielsen and shared through the Harvest to Home platform, supported through the Hort Innovation vegetable, sweetpotato and onion research and development levies. For more insights, visit the Harvest to Home website.

The Harvest to Home dashboard is an initiative of the Vegetable Cluster Consumer Insights Program and is funded by Hort Innovation using the vegetable, sweetpotato and onion research and development levies and contributions from the Australian Government.

Project Number: MT17017

Note: Major supermarkets are defined here as the sum of Woolworths, Coles and Aldi.

Sources:

- Nielsen Homescan 52 weeks to 29/12/2019

- Nielsen Total Food View, Total U.S. xAOC, 13 Weeks Ending 9/28/19:, UPC-coded and random-weight/Non-UPC data; Nielsen Homescan

- Attitudinal reports prepared by Nielsen for Hort Innovation, survey sample minimum n=300, fieldwork from 15/08/2019 to 21/08/2019 for the Australian market. Copyright © 2019 Horticulture Innovation Australia.