Have you read the Potato Growers’ Biosecurity Manual?

5 July 2021

AUSVEG Advocacy update

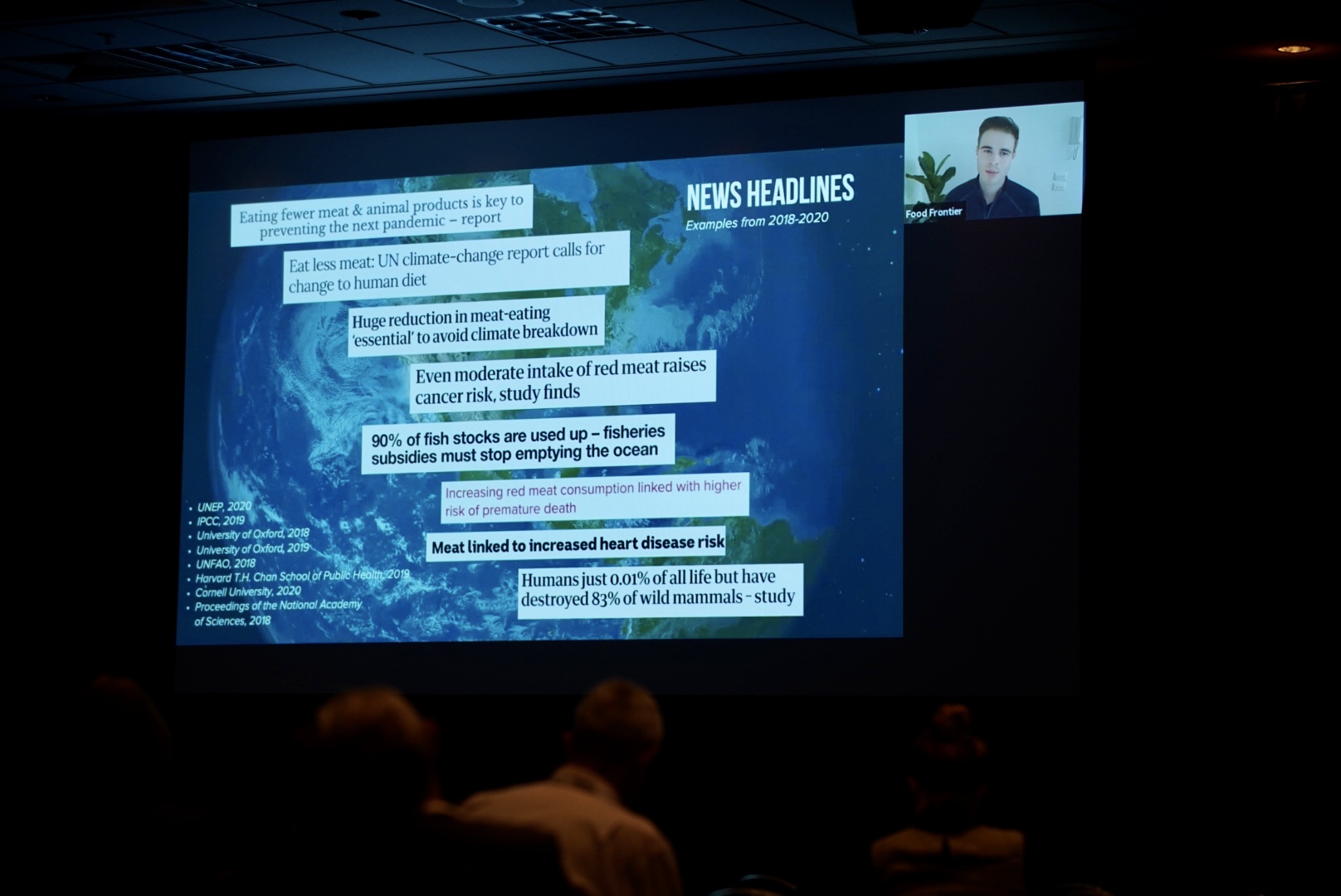

6 July 2021If the world’s consumption of meat and animal products continued at its current rate, we would need two planets of resources to meet the projected demand. Australians eat more meat than the rest of the world, consuming almost three times the global average according to OECD data. The data tells us we cannot sustain relying solely on traditional methods of protein production. So how do we create sustainable, and healthier, protein sources into the future? Food Frontier CEO Thomas King delved into these topics when he spoke to delegates at Hort Connections 2021.

What are people eating?

Research in 2019 by Colmar Brunton found one in three Australians identified as a ‘meat reducer’ – someone eating less meat – or a ‘flexitarian’, someone who enjoys multiple meat meals each week but has a strong emphasis on plant-based eating as well.

Only around 10 per cent of respondents identified in the mostly meat-free demographics of vegetarian or vegan.

“That number has remained pretty stable for the last few years. It’s actually the meat reducers and flexitarians that seem to have grown, which also makes sense in terms of the new plant-based products we’ve seen hit the market shelves,” Thomas said.

“[There are] a large number of consumers who are seeking to reduce their meat consumption, but still want the convenience and familiarity of the sorts of meals they’re used to eating or serving up for the kids.”

Meat-free alternative products readily available in stores include traditional options such as tofu, tempeh or falafel, through to food mimics, where fruits, vegetables, or fungi are turned into a meat-like product.

“In the last five or so years, we’ve seen the emergence of what we call new generation, plant-based meat brands that are offering consumers an option that mimics more of the experience of cooking and eating the meat that they’ve come to know and love,” Thomas said.

“The main consumer demographic that they’re targeting are those meat reducers and flexitarians – people who aren’t reducing their meat consumption because they don’t enjoy the taste. They’re reducing their meat consumption for those health, environmental or other factors, but still want familiarity and convenience.”

Most of these new generation plant-based meat brands use soy, wheat, or pea protein, while some brands are starting to explore protein from potato, rice, quinoa, chia, and lupins.

Emerging industry

Food Frontier’s 2020 State of the Industry report by Deloitte Access Economics found Australia’s industry for plant-based meats doubled in revenue and jobs over the last financial year, with Australians spending $185 million within the category.

The number of plant-based meat products at major Australian supermarkets also doubled within this period, and even some of the biggest meat producers in the world are either releasing their own plant-based product lines or acquiring existing plant-based companies.

So how can Australian producers benefit from this emerging industry, which is projected to reach $3 billion by 2030?

“By diversifying our protein offerings, the Australian agrifood sector can set itself up to be more competitive in a changing global food market and a changing protein landscape,” Thomas said.

“Our region is home to more than half the world’s population, which is driving the really bad protein and meat consumption trajectory. And that’s demand for protein across the board – obviously meat and traditional protein, but also alternative proteins.”

“For example, the demand for plant-based meat products in China and Thailand is forecast to increase by 200 per cent over the next five years. And over the next five years across the entire Asia Pacific region, it’s expected there’ll be a 25 per cent increase, reaching US$1.7 billion. Australia and New Zealand are in a prime position to capitalise on our strengths to lead in this market alongside the traditional protein markets.”

Future opportunities

Thomas said there are big opportunities to leverage protein-rich crops such as fava beans, lentils, lupins, and chickpeas that are grown widely in Australia, but predominantly exported as a commodity. Other ingredients including fats like sunflower and canola oils, plus vegetables and plant-derived ingredients used for colour, texture and nutrition are also needed for production.

“Last financial year we saw a 70 per cent increase in the domestic production of plant-based meats, and many of those leading local companies have indicated strongly their desire to use more Australian ingredients in their products,” he said.

“By value-adding and processing it locally by extracting protein needed for these sorts of growing food categories, we can actually generate additional value within the Australian agriculture sector.”

Watch the recording: Thomas King at Hort Connections 2021 | Future opportunities in Alternative Proteins

Find out more

Please visit the Food Frontier website.

Cover image: Thomas King addressing delegates virtually at Hort Connections 2021. Photography by Andrew Beveridge.