Growing resilience and meeting regional needs

28 May 2025

Addressing pollination challenges in cucurbit production: enhancing resilience in Australia’s horticultural sector

28 May 2025The Australian fresh vegetable export landscape has experienced various changes and challenges in recent years. Fluctuating demand across global markets, evolving international trading conditions and the reduction or elimination of tariffs for competing countries in key markets have impacted Australia’s competitive position.

Despite these pressures, the Australian vegetable industry continues to adapt, actively pursuing new opportunities and working to strengthen its presence in key export markets. In 2024, total vegetable exports declined by 5 percent in both export value and volume, representing a reduction of $12 million and drop of 9,717 tonnes. Carrot, potato and onion remained the top three most exported crops, with potato exports increased by 20 percent in value, from $40 million to $48 million, and 14 percent rise in volume to 48,295 tonnes.

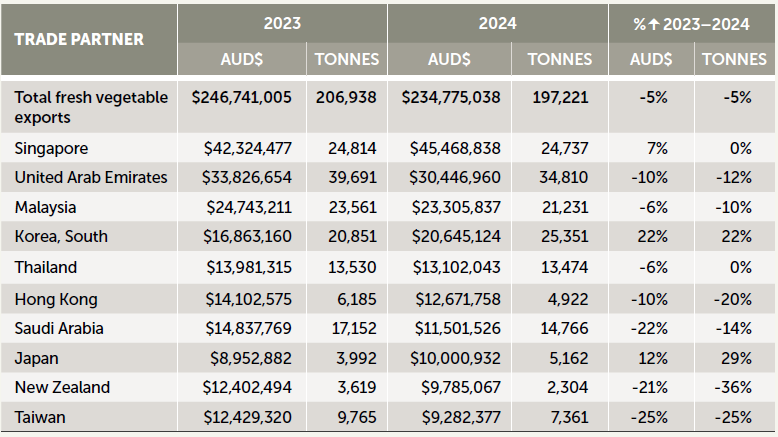

From January to December 2024, Australian fresh vegetable exports were valued at $235 million, with a total export volume of 197,221 tonnes. Singapore, the United Arab Emirates, Malaysia, South Korea and Thailand were the top five markets for fresh vegetable exports over this period.

Singapore held its position as the top Australian fresh vegetable export destination by value, with an increase in export value by 7 percent, from $42 million to $45 million and export volume maintained at 24,737 tonnes. Exports to the United Arab Emirates decreased by 10 percent in value, from $33 million to $30 million, and dropped 12 percent in volume, from 39,691 tonnes to 34,810 tonnes. Growth continued in the South Korean market, recording a 22 percent increase in export value and a 22 percent climb in volume. Australian fresh vegetable exports to Thailand dropped 6 percent in value for close to the same volume as the previous year (refer to Table 1).

Change in Australian vegetable exports by global market

Vegetable export by crop

Root vegetables such as carrots, potatoes and onions remained the top three export crops for the industry. Asparagus exports increased by 18 percent in value and six percent in volume to 4,444 tonnes. Celery exports had a year of positive growth in 2024, growing nine percent in value and 27 percent in volume (refer to Table 2).

Change in vegetable exports by crop

Australian Onion Exports

Australian onion exports saw a mixed performance in 2024, with overall value dropping by 8 percent from $44 million to $40 million, and a slight reduction in export volume of 463 tonnes to 42,390 tonnes compared to previous year.

Thailand, the United Arab Emirates, Netherlands, Malaysia, and Japan were the top five export destinations for Australian onions.

The United Arab Emirates recorded modest growth of 5 percent in value despite a slight 2 percent dip in volume. The Netherlands saw a 25 percent rise in export value from $3.5 million to $4.3 million, with an increase in export volume of 50 percent, from 2,583 tonnes to 4,087 tonnes. Japan performed strongly in 2024, with a 40 percent increase in export value from $2.1 million to $3 million and 65 percent increase in volume, from 1,575 tonnes to 2,593 tonnes.

Belgium, Singapore and Germany also recorded positive growth, especially with onion exports to Belgium climbing 49 percent in value and 62 percent in volume. On the other hand, Spain recorded a sharp decline, with both value and volume falling by 62 percent and 66 percent respectively (refer to Table 3).

Change in Australian onion exports by global markets

Market outlook for onions

Indonesia

From January to December 2024, Australian onion exports to Indonesia were worth $1.2 million at 1,724 tonnes. Tasmanian onions accounted for approximately 85 percent of this volume.

Historically, Tasmanian onions have held a reasonable market share of Indonesian onion imports. However, the market dynamics and trading conditions shifted significantly in September 2024 when New Zealand successfully negotiated the removal of pre-export methyl bromide fumigation requirements with the Indonesian government.

This development is a strong achievement for New Zealand’s Ministry for Primary Industries (MPI) in ensuring a viable export pathway for New Zealand’s onion industry.

As a result, New Zealand onion exports to Indonesia have resumed with reduced import conditions and fumigation requirements, eroding the market share previously held by Australian onion exporters. While Australian onions are now subject to strict fumigation requirements, the removal of this barrier for New Zealand onions has serious implications for Australian onions’ future market access and market share in the Indonesian market.

AUSVEG has been actively engaging with the Department of Agriculture, Fisheries and Forestry (DAFF) and Australian onion grower-exporters to resolve the current trade challenges and seek improved market access conditions in Indonesia.

While the situation remains complex and uncertain, there are ongoing efforts between the industry and government to ensure that Australian onions remain competitive in key export markets, including Indonesia. Grower-exporters will be kept informed of developments, and AUSVEG remains committed to supporting the industry through constructive engagement with government and international stakeholders.

Europe

Australian onion exports to Europe are a significant contributor to Australia’s vegetable exports, with countries like the Netherlands, Spain, and Belgium being major importers.

Australian onion exports to Europe are expected to decline in 2025, primarily due to the New Zealand-European Union (NZ-EU) Free Trade Agreement (FTA) entering into force on 1 May 2024, which saw the 9.6 percent New Zealand onion tariff eliminated, giving New Zealand onions a competitive advantage in the market over Australian onion exports.

The delay in finalising the FTA between Australia and the European Union has disadvantaged the Australian onion industry. With trade tensions, tariff measures and disruptions to the global trading environment, it is critical that the recommencement of negotiations for the Australia-European Union FTA is prioritised by whomever forms the next Australian federal government.

Encouragingly, in March 2025 the EU’s top diplomat in Australia called for the urgent resumption of the stalled FTA negotiations between Australia and the 27-nation EU bloc, stating that an FTA between Australia and the EU is a ‘no-brainer’ as the US tariffs continue to disrupt the global trading landscape.

The recommencement of negotiations would be strongly welcomed by the Australian onion industry and AUSVEG will engage with the Australian FTA negotiators to seek the same tariff elimination outcome on Australian onion imports to the EU that was agreed in the previous deal.