Seasonal measures for Brown marmorated stink bug (BMSB)

11 August 2022

A study of daughter succession in a changing family farm environment

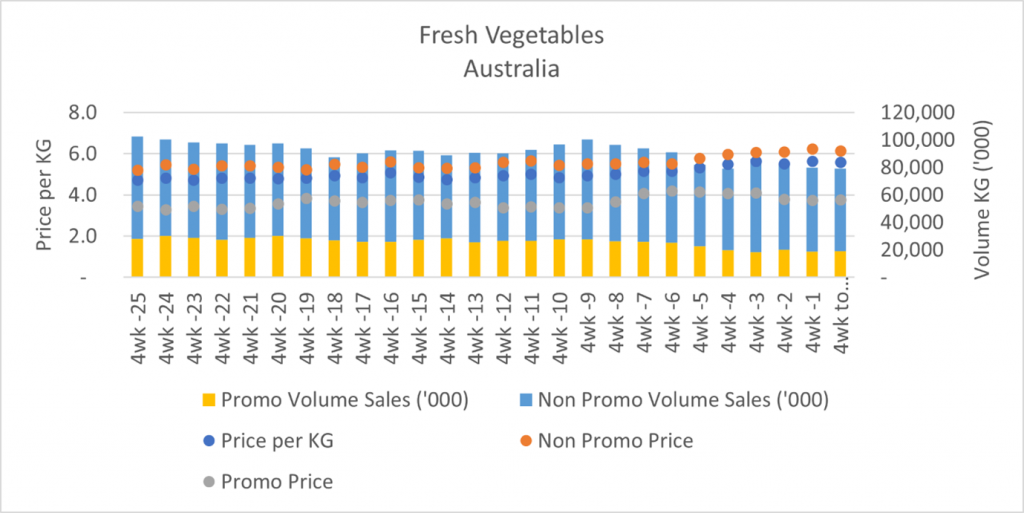

12 August 2022Continuing AUSVEG’s look at pricing issues within the fresh produce supply chain, AUSVEG has delved into the world of retail ‘specials’ and ‘promotion’ pricing. The dataset provided, thanks to Hort Innovation and NielsenIQ, shows some interesting learnings of the use of ‘specials’ by the supermarkets.

Anecdotally many growers have said that supermarkets will often use specials to assist in clearing stock during an oversupply in the market.

When done properly, this can be considered generally a positive thing as a special can drive greater demand by the consumer – so in that sense it’s a win-win for all.

However, the dataset below and anecdotal feedback from growers tells a different story in that many fresh produce lines are fairly consistent in the percentage of volume which is on promotion.

Across all fresh vegetables there is anywhere between 19-24 per cent of the total volume of produce on promotion at any one time.

This seems quite high.

That is every 1 in 5 fresh vegetable products on the shelf is under a promotion.

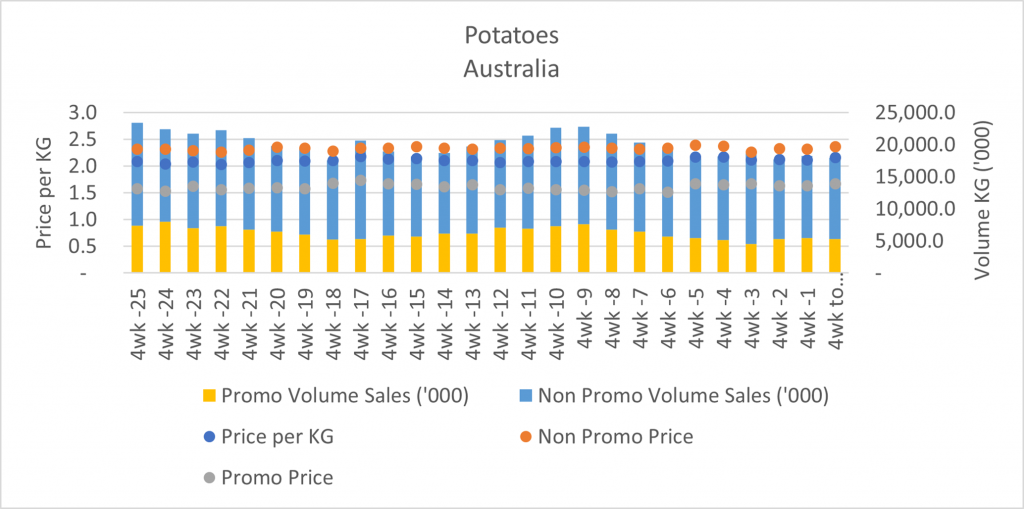

While this does vary for different commodities, some such as potatoes can be as high as 36 per cent on promotion. That is every 1 in 3 potatoes on the shelf at any one time is on promotion.

Now the tables below show the total promo volume and non-promo volume based on the total volume on the market.

It should be noted that each supermarket will have varying volumes for each product which is on promotion, and each will have their own percentage of the market.

However, the high rate of promotions across the sector at any one time is no doubt a challenge for the growers. It means that the market is not free to operate solely under supply and demand.

The question is how does the rest of the market compete when there is such a large volume of product already sold at a promotional price?

*Hort Innovation Australia calculation based in part on data reported by NielsenIQ through its Homescan Service for the fresh vegetables category to 24 April 2022, for the Total Australia market, according to the NielsenIQ standard product hierarchy. Copyright © 2022, Nielsen Consumer LLC.

Promotion Pricing v Standard pricing

The pricing piece of the above tables also shows a high disparity between the average product price compared with the average promotion price.

The promotion pricing is significantly lower than the non-promo price.

Most would say that’s obvious, it’s a promotion after all.

However, if the promotion price is significantly lower than the standard price, and there is a high volume of product which is on special, it puts greater pressure on the rest of the market.

Across fresh vegetables the promotional price is regularly 30-40 per cent less than the non-promotional price.

The questions is, how high can the market really go when it is competing against 30 per cent of the volume being sold at a significantly reduced price?

AUSVEG is continuing to raise these issues with the relevant stakeholders including politicians and regulators to ensure growers receive a fair price in a competitive market.

Food and Grocery Code of Conduct

AUSVEG recently met with the Food and Grocery Code of Conduct independent reviewer Chris Leptos who last year published his findings as part of the Food and Grocery Code Independent Review.

As part of the review, supermarkets who have signed up to the code must report on price rise negotiations.

An excerpt of the report published in 2021 is below.

Woolworths received 237 notifications of a price rise request and entered into negotiations with 94 of them. Of these, 75 negotiations were not concluded within 30 days of the initial request being made. The most number of days Woolworths took to conclude its position on a negotiation, starting from the notification day for the relevant proposed price increase, was 87 days.

Coles received 1,101 notifications of a price rise request and entered into negotiations with 35. Of these negotiations, 32 did not conclude a position within 30 days. The most number of days Coles took to conclude its position on a negotiation, starting from the notification day for the relevant proposed price increase, was 107 days. Coles’ reported figures included 724 fresh fruit and vegetable price negotiations.

Aldi received 45 notifications of a price rise request and did not enter into negotiations following the requests.

Metcash appears to have failed to comply with clause 27B of the Code to provide information about price increase requests to the Code Arbiter. Metcash explained that although it had procured new systems to ensure its readiness to comply with the Code, it later identified that the data captured did not exactly correlate with the information required to be provided under clause 27B of the Code. Metcash has since chosen to undertake a separate process for collecting this information but, due to a delay in its implementation, does not expect to be able to comply fully with clause 27B for the 2021-22 reporting period. With the deployment of new systems in late 2021, Metcash have indicated that it will be able to provide at least 9 months of more complete data for the next Code reporting period.

It should be noted that just because a price rise is requested, it doesn’t mean that it will be accepted. However, a request for a price rise can generally be linked to suppliers’ need to cover costs.

The full report can be found on the Treasury website (details at the end of the article).

The report and discussion with the reviewer also found that suppliers were not making use of the independent arbiters during their price negotiations.

The independent arbiters are a requirement under the Food and Grocery Code of Conduct and designed to assist with dispute resolutions.

The independent arbiters for the four major supermarkets are listed below:

Coles

Hon. Jeff Kennett

03 9421 0977

jkennett@ausresolve.com

Woolworths

Helen McKenzie

0499 885 090

codearbiter@wowgrocerycode.com.au

ALDI

Bronwyn Gallacher

0433 292 777

bronwyn@cclconsultants.com.au

Metcash

Martin Shakinovsky

0416 235 766

complaints@metcashcodearbiter.com.au

Find out more: To read the Food and Grocery Code of Conduct independent review, please visit https://treasury.gov.au/sites/default/files/2021-11/p2021-229034_0.pdf.