AUSVEG Advocacy Update – 1 April 2022

1 April 2022

AUSVEG Advocacy Update

Confidence and cash flow struggle for growers

Growers are facing a challenge of confidence and cash flow as they battle with buyers to maintain their profit margins.

Record high input costs and lack of movement in the price received from buyers to reflect the increasing cost of production is testing growers’ confidence to plant their next crop.

Having dealt with the worst of the COVID-19 pandemic, labour shortages and supply chain disruptions, growers are now facing their biggest test in maintaining profitability.

Growers are also struggling to maintain a steady cash flow, which is also heavily impacting their confidence to continue to take on the business risk of planting a crop, incurring more debt without any assurance of future profitability.

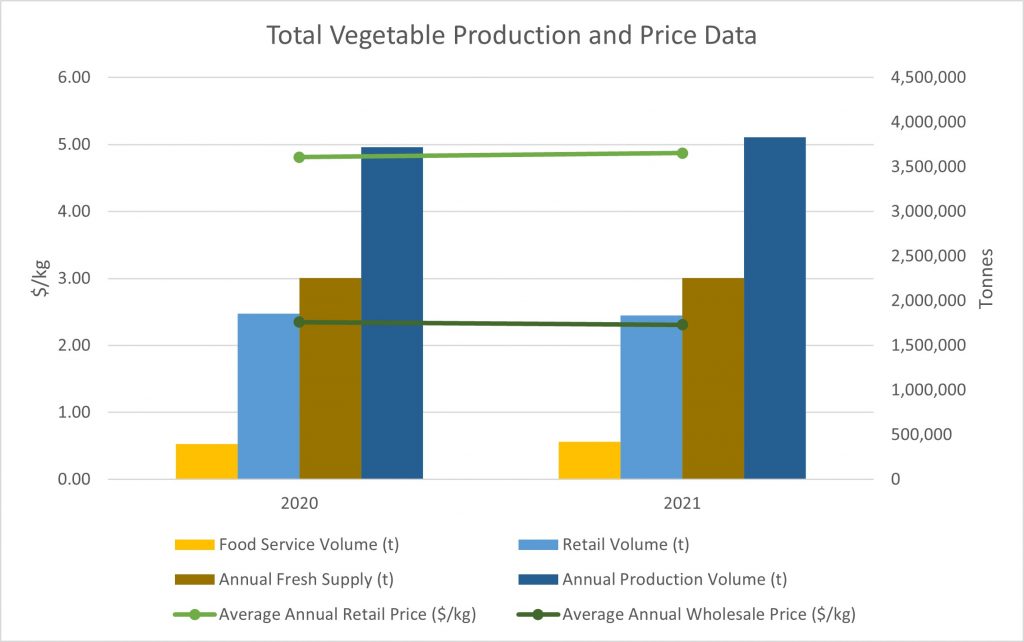

The latest update from AUSVEG examines further how vegetable and potato volumes have remained consistent over the last few years, as has the retail and wholesale price. But despite this, costs of production have increased and is pressuring growers to now sell produce below the cost of production.

Not isolated to fresh produce industry

Recent data from the Australian Bureau of Statistics (ABS) indicates that 39% of all businesses expect the price of their goods and services to increase more than usual, and 40% reported an increase in operating expenses over the last month, compared to 24% the same time last year.

According to the report, nearly all businesses anticipating price increases (97%) said these were being driven by rising non-staff related operating expenses. These included rising fuel and energy costs (88%) and increases to the cost of products and services used by the business (88%).

More information from the ABS can be found here.

This is consistent with what vegetable and potato growers have told AUSVEG, with many growers indicating that costs are rising at a faster rate than any price increases they are receiving from their buyers.

Cost of production up, lack of movement in prices from buyers all hurting growers’ bottom line

Annual fresh vegetable production has remained relatively stable over the last three years, along with retail and wholesale market prices.

However, growers’ costs have risen significantly.

Margins are critical for any business owner. If your margins shrink – or worse, disappear – so does the confidence business owners have to take on the next business risk or, in the case for vegetable growers, planting the next crop.

Like any market, there are peaks and troughs. However, the volatility of the fresh produce market currently indicates that there is only one fair solution to inject confidence back into the sector: growers receiving a fair price for their produce.

| Fresh Vegetables | 2020 | 2021 | % change |

| Annual Production Volume (t) | 3,722,467 | 3,831,300 | 2.92% |

| Annual Fresh Supply (t) | 2,252,838 | 2,255,723 | 0.13% |

| Retail Volume (t) | 1,854,999 | 1,835,417 | -1.06% |

| Food Service Volume (t) | 397,841 | 420,310 | 5.65% |

| Average Annual Retail Price ($/kg) | $ 4.81 | $ 4.87 | 1.25% |

| Average Annual Wholesale Price ($/kg) | $ 2.35 | $ 2.31 | -1.74% |

Annual production stats don’t match buyer feedback

AUSVEG is regularly told by growers and buyers that there is often an ‘oversupply in the market’ which forces prices down.

AUSVEG has looked at more detail over the supply issue on some core vegetable lines, noting that fresh vegetable prices have remained largely unchanged.

The results are largely inconsistent with the general commentary of an oversupply of production.

The recent data collected through the Hort Statistics Handbook from Hort Innovation, as well as from respected insights company Nielsen, shows that overall fresh vegetable production has remained stable.

While AUSVEG understands there will always be fluctuations in volumes throughout the year, production overall has not changed.

Data presented below on some vegetable lines highlights the inconsistencies in the current market.

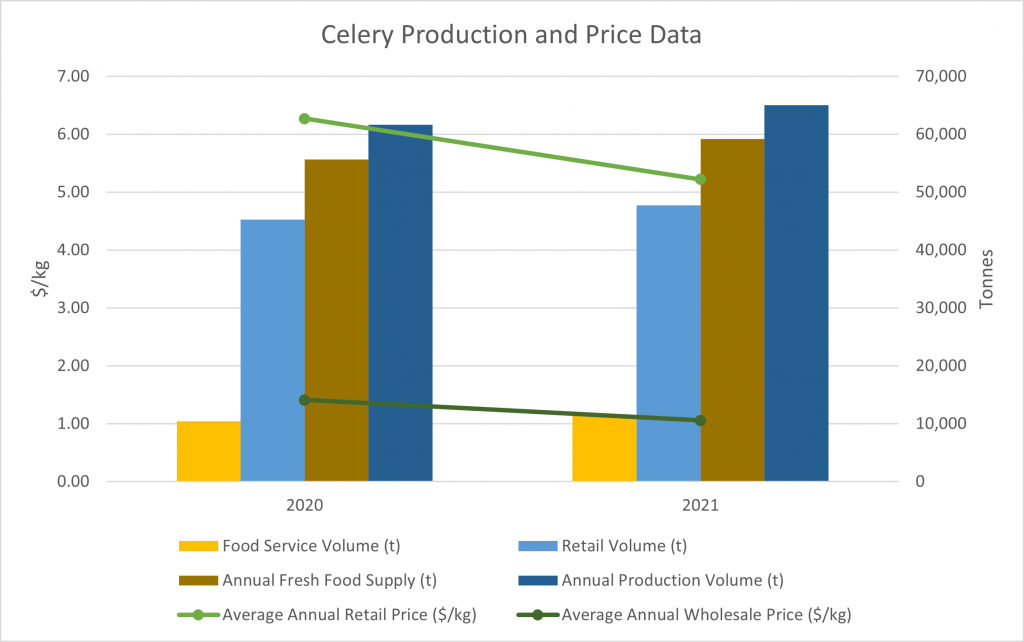

The above celery production and price data paints a stark picture where prices have fallen significantly despite a minor increase in production volume. The below table shows celery increased fresh supply production volume by just 6.37%, yet the average annual retail price fell by 16.74% and even more stark, the average annual wholesale price fell by almost 25%.

| Celery | 2020 | 2021 | % change |

| Annual Production Volume (t) | 61,673 | 65,043 | 5.46% |

| Annual Fresh Supply (t) | 55,630 | 59,179 | 6.37% |

| Retail Volume (t) | 45,228 | 47,725 | 5.52% |

| Food Service Volume (t) | 10,402 | 11,454 | 10.11% |

| Average Annual Retail Price ($/kg) | $6.27 | $5.22 | -16.74% |

| Average Annual Wholesale Price ($/kg) | $1.41 | $1.06 | – 24.94% |

The data is intended as a guide to give some indication as to what is happening in the market and the misalignment between supply and price – both retail and wholesale.

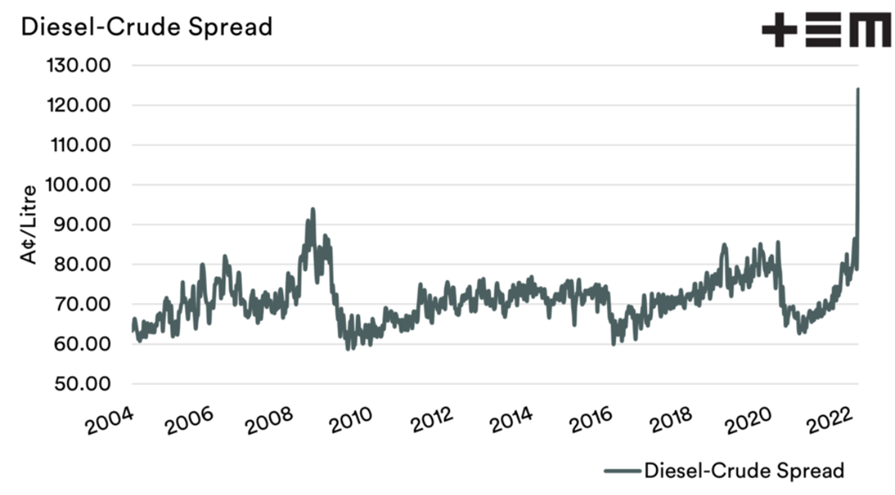

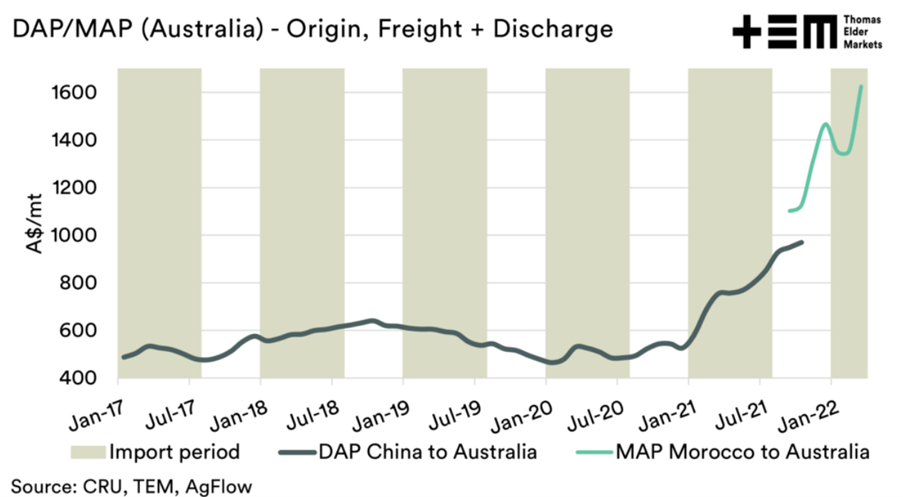

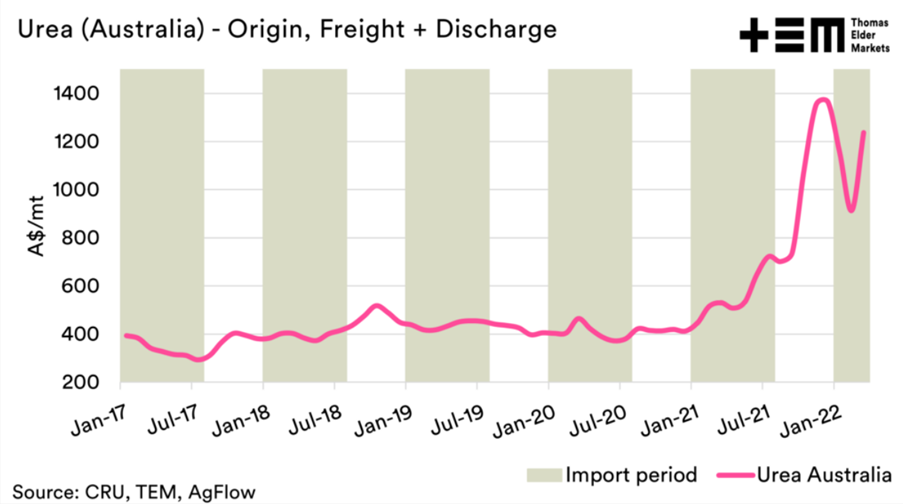

This data does not take into account the impact of increases to costs of production, including critical farm inputs, including fertiliser, chemicals and fuel having increased by more than 40 per cent.

According to the data available to industry on annual vegetable production, there is no support to the claim that there is an oversupply of fresh vegetables in the market. AUSVEG encourages growers to use this information and challenging buyers around proving or demonstrating the supposed ‘oversupply in the market’ at different times.

See below an analysis from AUSVEG of a basket of the most common vegetable commodities that consumers purchase to see an overview of production and price data.

Cost of Production Price Change Data 2022

| Cost | Jan 2020 | Jan 2022 | Percentage change |

| Urea | AUD$313.59/mt* | AUD$1,179.29/mt | 276.06% |

| Diesel | AUD$0.59/lt | AUD$0.80/lt | 35.6% |

| DAP | AUD$385.65/mt | AUD$974.47/mt | 152.7% |

| Crude Oil | USD$51.56/bbl | USD$110.70/bbl | 114.7% |

| Average | 144.76% |

*Metric tonne

Data above collected from Index mundi at www.indexmundi.com and Trade Economics at https://tradingeconomics.com. Currently there is limited free and up-to-date data available.

**The below graphs are attributed to Thomas Elder Markets.

Recent reporting on farm input costs and vegetable supply:

- Market Morsel: ‘Putin’ a floor in fert pricing – Thomas Elder Markets

- Market Morsel: Fuels Furious Advance – Thomas Elder Markets

- Food inflation: The impact for both farmers and shoppers | The Weekly Times (weeklytimesnow.com.au)

- Farmers will be the ‘last’ to see gains from food price increase | The Australian

- Vegetable prices – PRIME7

- Floods put rocket under fresh food prices (theaustralian.com.au)

- Vegetable shortages are wiping meals off menus and customers are set to foot the bill for rising supply costs – ABC News

- Price rises are hitting consumers as inflation takes off. These are some items that are going up now – ABC News

- Federal Budget 2022: Prime Minister Scott Morrison gives hint about petrol relief | news.com.au — Australia’s leading news site

- Queensland citrus growers feel the squeeze of increasing fuel costs – ABC News

- Fresh and frozen food prices will stay high for months, supermarket boss says – ABC News

- Cost of living pain as blanket fuel price levy hits fruit, vegetable freight operators | The Courier Mail

- What item on your grocery list has increased the most this year? – WA Afternoons – ABC Radio

- Ukraine crisis: Global supply chains to feel impact | The Weekly Times (weeklytimesnow.com.au)

- Farm inputs not floods to push prices higher | Queensland Country Life | Queensland

*AUSVEG will continue to work with Hort Innovation and other stakeholders to publish more market information to ensure growers have the information they need to make the best business decision possible.