AUSVEG Advocacy Update – 14 February 2023

Pricing and Inputs

Farm inputs have remained elevated for the start of 2023 compared to pre-Covid levels. While they are still far above pre-Covid levels, some input prices have moderated from their peak last year.

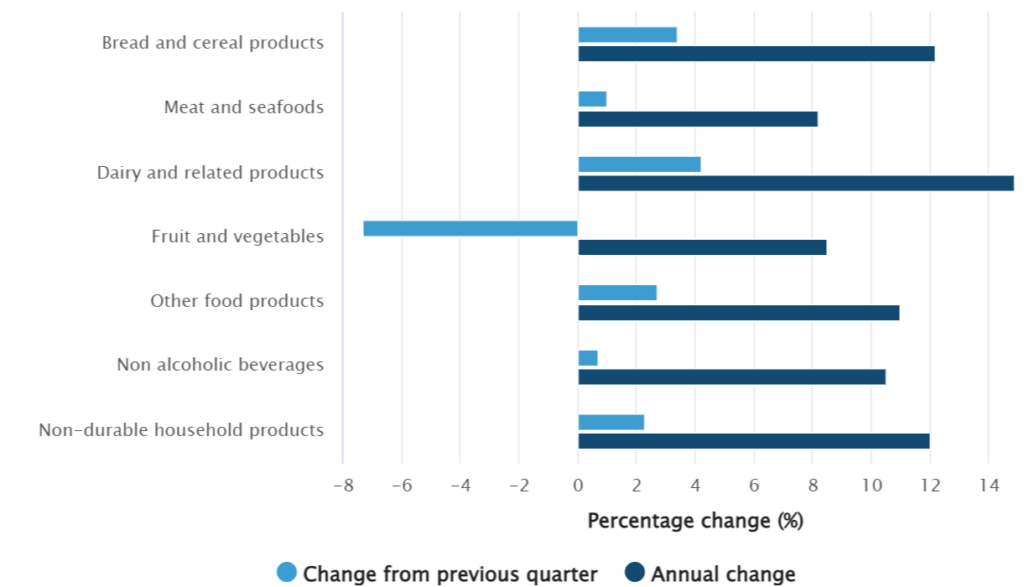

Over the December 2022 Quarter there were significant price rises for many food and grocery products, largely due to of strong demand over Christmas and elevated input costs.

Fruits and vegetables had their most significant quarterly fall since 2012, although prices are still elevated compared to 12 months ago. This fall can be attributed to the high prices of fruits and vegetables in the September 2022 Quarter following intense flooding events along the East Coast during the year.

Due to the relentless flooding and severe weather events, summer plantings have been reduced, putting pressure on vegetable prices for the start of 2023.

Figure 1. Grocery products, Australia, quarterly and annual movement (% change in price) (ABS).

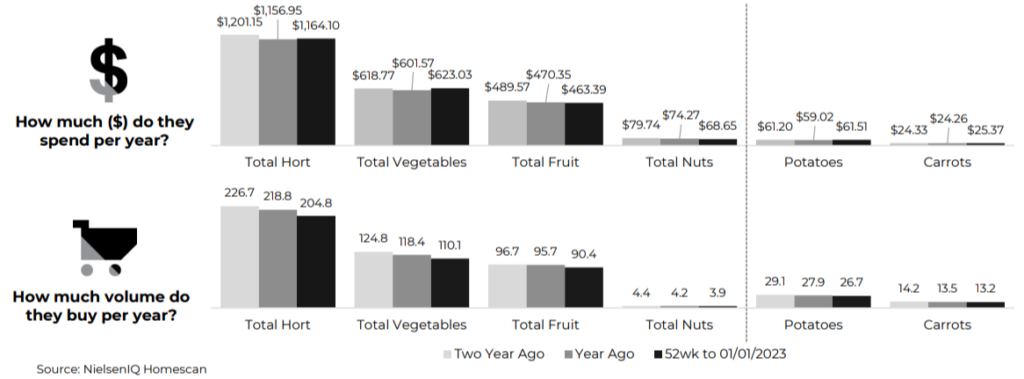

With regard to consumer buying habits of vegetables, Figure 2 highlights the amount spent on vegetables per year has increased while the average volume has declined.

Pre-packed vegetables are also contributing over 60 per cent to total vegetable sales.

Figure 2. Australian Household purchasing habits, 52 weeks to 01/01/2023 vs years prior.

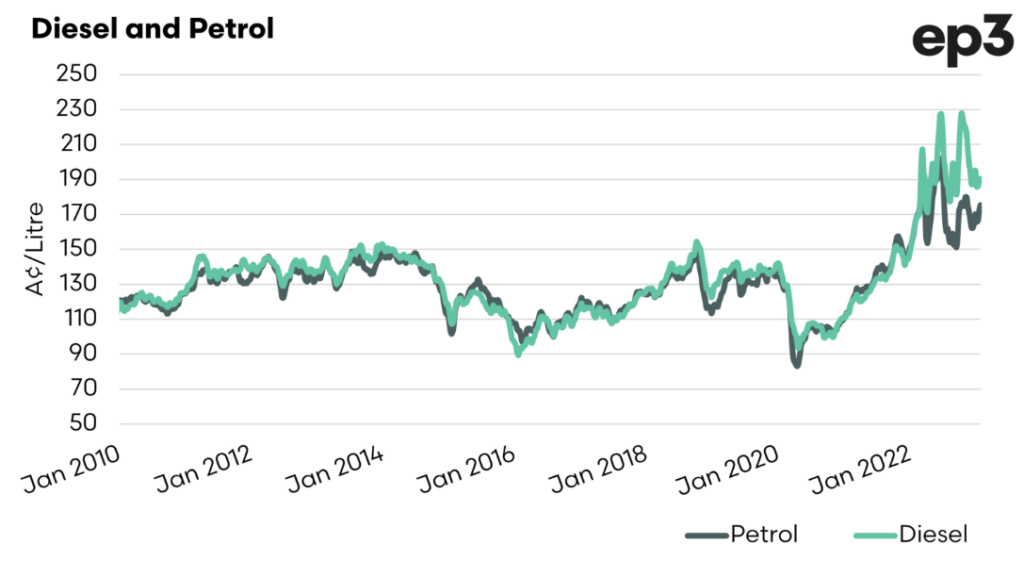

Diesel

- Diesel prices have started to fall but are still at a decade high, they are now sitting at an average of A$1.90/l (wholesale).

- Diesel prices are 9 per cent higher than petrol, earlier in 2022 this was around 30 per cent.

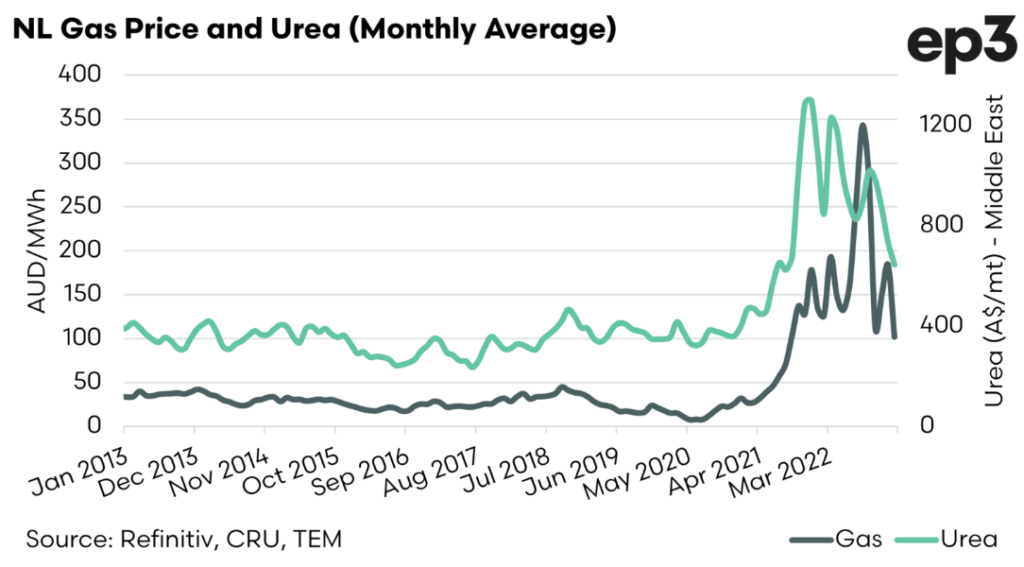

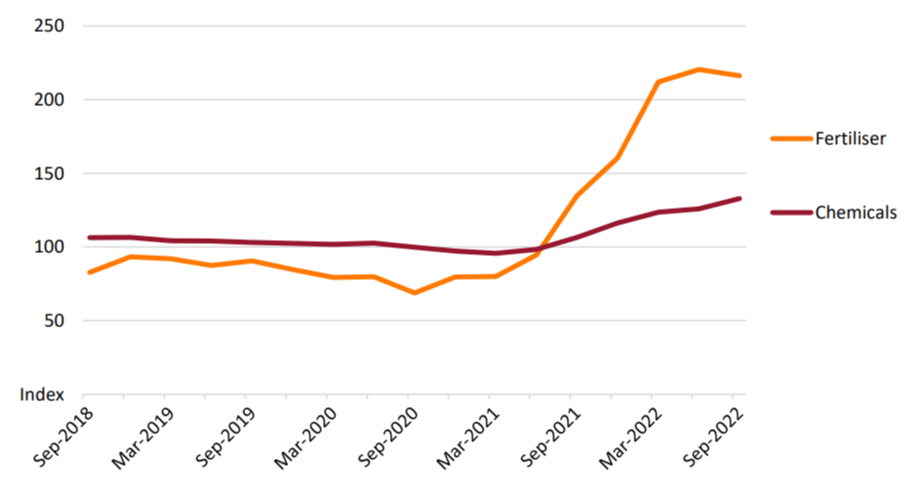

Fertiliser

- Fertiliser pricing levels are falling globally.

- Cost of energy is the main driver, especially natural gas costs. The price of natural gas has skyrocketed since the Russian invasion of Ukraine.

- Urea from the Middle East has dropped to an average of AUD$645/mt for the month of January. This time last year Urea was AUD$1090/mt.

- Australian farms are continuing to import fertiliser despite high global prices. For vegetable growers, this is significantly impacting profit margins.

Figure 3. Import price index, Australia (DAFF).

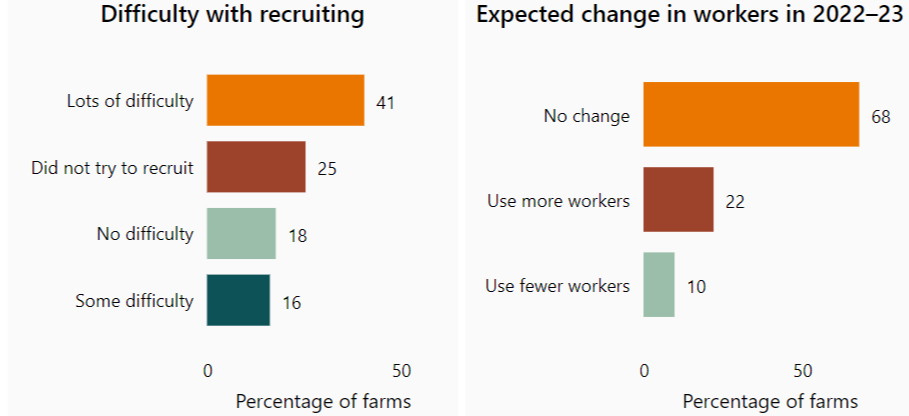

Workforce

Key labour statistics from ABARES on all of horticulture:

- Labour costs make up 35 per cent of the total operating expenditure.

- 40 per cent of farms are using advanced machinery to reduce demand for labour.

- 35 per cent of workers worked longer hours compared to previous years.

- 13 per cent of farms provided on-farm accommodation.

- 4 per cent of farms used on-farm accommodation during peak labour use periods.

Figure 4. Horticulture Workforce Characteristics 2021-22 (ABARES).

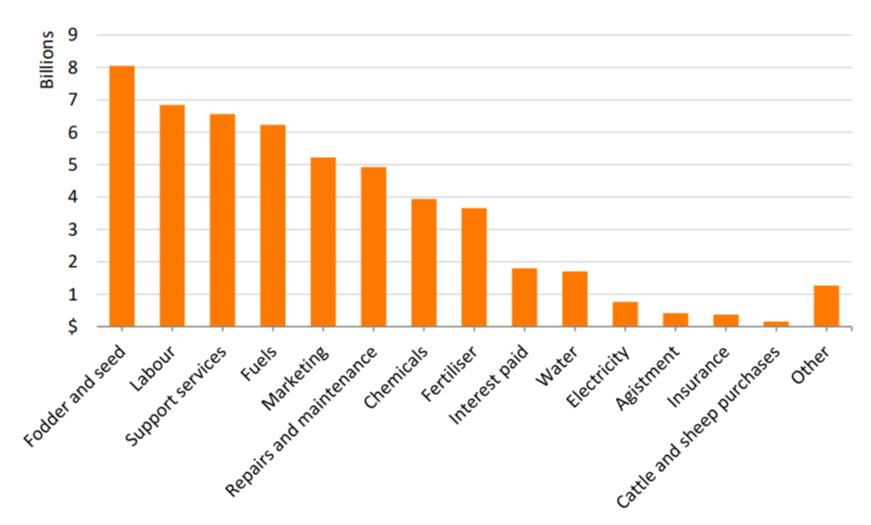

Figure 5. Estimated aggregate farm cash costs, Australia, 2021-22 (DAFF).

Across all farms, labour costs are the second biggest expense, fuels fourth, and chemical and fertiliser 7th and 8th. Whilst this graph includes all farm types, we know that horticulture has some of the highest labour costs of all farm types.

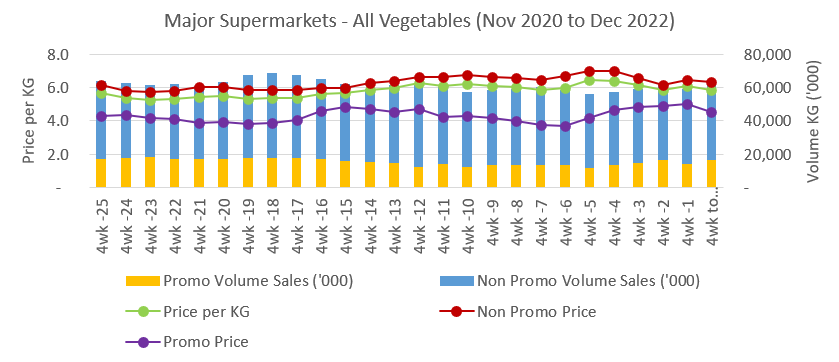

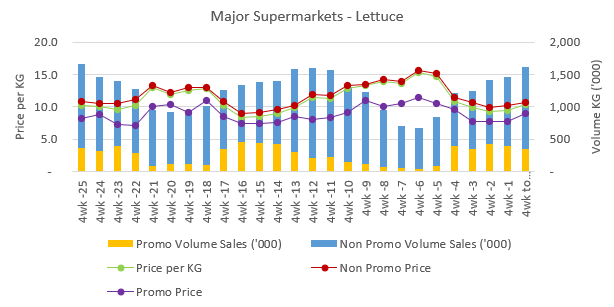

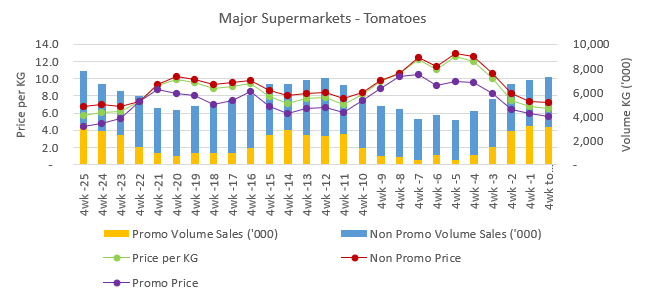

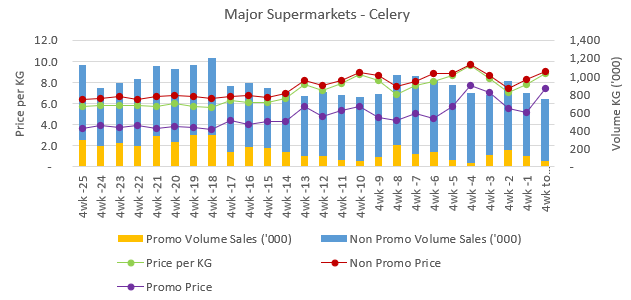

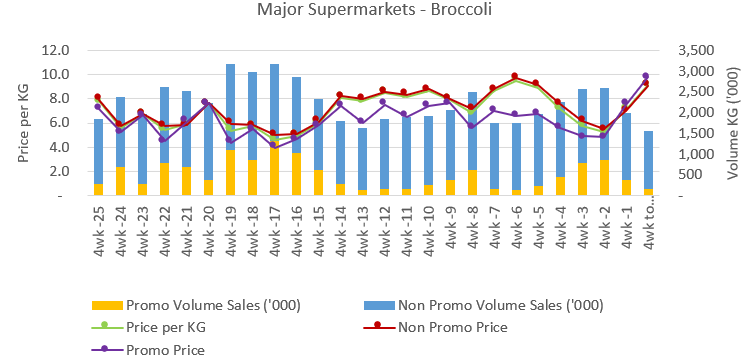

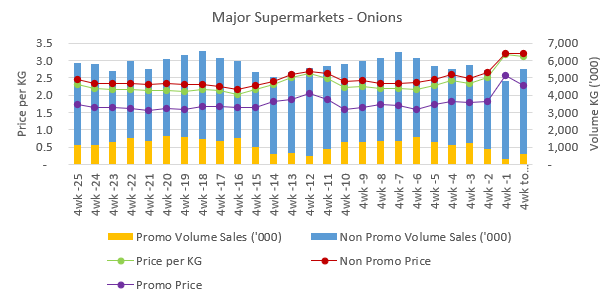

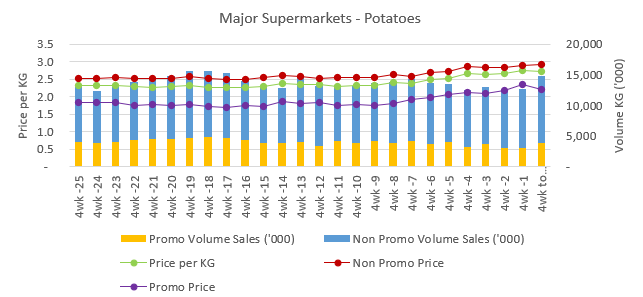

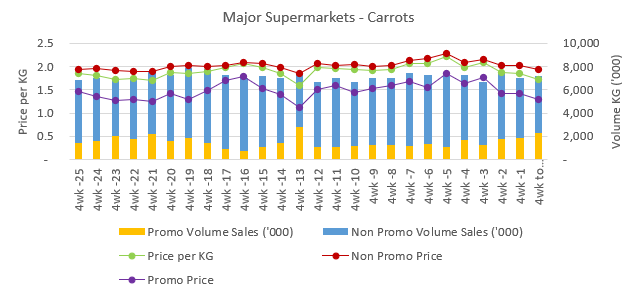

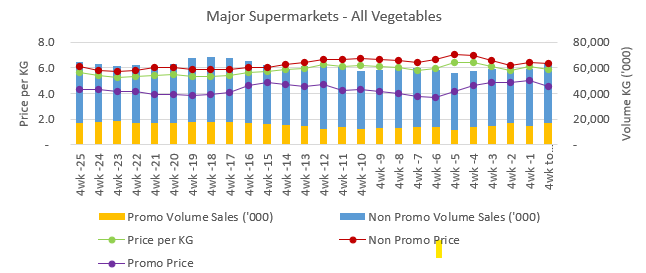

Major Supermarket Pricing for Vegetables

(All graph timelines are from November 2020 to December 2022).

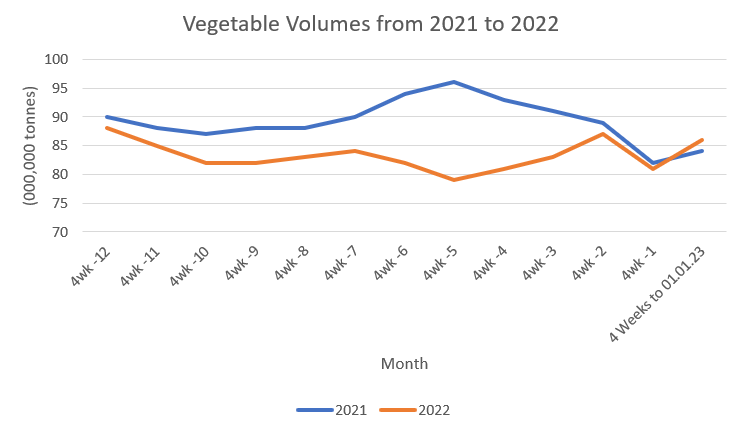

As indicated in the first graph below, (Australia – All Vegetables), there is a noticeable decrease in the total volume of vegetables from 2021 to 2022. This is highlighted more clearly in the second figure, which shows the average drop in volume of all vegetables, largely due to the extreme weather, labor shortages, and inputs pricing.

Hort Innovation Australia have calculated this information based in part on data reported by NielsenIQ through its Homescan Service for the Papaya industry with data to 27th March 2022, for the Total Australia market, according to the NielsenIQ standard product hierarchy. Copyright © 2022, Nielsen Consumer LLC.

Hort Innovation Australia have calculated this information based in part on data reported by NielsenIQ through its Homescan Service for the Papaya industry with data to 27th March 2022, for the Total Australia market, according to the NielsenIQ standard product hierarchy. Copyright © 2022, Nielsen Consumer LLC.

AUSVEG Food and Grocery Code of Conduct (FGCC) – Dispute Resolution Submission

Treasury recently conducted a review of the FGCC, the review focused specifically on Part 5: Dispute Resolution.

AUSVEG made a submission highlighting the dispute resolution process was effectively unusable for vegetable growers due to the perishable nature of vegetables. Because of the lack of contracts, quick turnover, and unique way the industry negotiates with retailers (on a weekly basis), vegetable suppliers cannot utilise the code’s processes.

The Annual Report by the Independent Reviewer highlighted that some of the core reasons the process wasn’t used were included fear of retribution and fear of damaging commercial relationships. This is highly relevant to the vegetable industry.

AUSVEG will seek comprehensive input from vegetables growers to include in the next review of the code in October 2023, which will cover the code in its entirety.

Select Committee Hearing on the Cost of Living

AUSVEG highlighted the significant challenges that growers have faced in dealing with the rising costs of production, the power imbalance between growers and retailers, and worker shortages at the Senate Select Committee Hearing on Cost of Living in Melbourne on Tuesday 2 February 2023.

AUSVEG Chair Bill Bulmer and CEO Michael Coote addressed the Committee to detail the hardships faced by growers all over the country over the last 12 months, which include increases to critical farm inputs, labour shortages, retailer price challenges, and significant weather events that have impacted production and the availability of fresh produce.

AUSVEG understands the challenges that Australian families are facing with the increases in the costs of living, but it is important to remember that the price that consumers pay for their fresh produce is vastly different to the price that the grower receives.

In 2022 the price of vegetables remained relatively stable in the retail sector despite skyrocketing cost increases of over 200 per cent in some key inputs. The stable price was due to growers who were forced to absorb rising costs to keep prices down for consumers, whilst struggling to keep economically viable.

AUSVEG advised the Committee that part of the long-term solution to this issue is changing the current perception and building awareness of the fresh produce sector in the public eye to educate the public about the food system and the real cost of fresh produce. If we don’t, we risk the future production of fresh produce if horticultural businesses to become financially unviable.

Consumers have shown tremendous support to the sector in buying fresh produce when they can, but there is no denying that this has been the most challenging period for our industry in recent memory.

Another clear message that AUSVEG conveyed was that it is critical to support growers to be able to supply healthy fresh produce to consumers. However, there needs to be a national, coordinated approach to help increase the consumption of fresh vegetables and fruits.

Low vegetable consumption is a multi-billion-dollar problem that is impacting the economic, health, social and environmental wellbeing of Australians which has significant flow on effects to the health care system. Increasing consumption could create greater economies of scale and increase the capacity and viability of rural and regional businesses, and ultimately build stronger communities and more jobs.

Workforce was also a key topic of discussion; the vegetable industry is currently short approximately 10,000 workers. During COVID-19 pandemic we saw a mass exodus of foreign workers, many of whom were working in agriculture. Many growers are unable to pick their produce, forcing them to destroy or abandon perfectly good produce, or be overly cautious and only plant a conservative volume. We know that the current workforce situation is hampering business growth and confidence throughout the industry.

AUSVEG also spoke about sustainability and climate change and highlighted the decades of on-farm improvements growers have undertaken to become more sustainable, such as increasing efficiencies in irrigation management.