AUSVEG Advocacy Update: 16 December 2022

Spinach recall

As you may have seen in the media, there has been a recall of baby spinach products sold in Costco stores in NSW, Victoria and the ACT. The affected products are isolated to a single brand with use by dates from 16 December 2022 up to and including 28 December 2022.

Food Standards Australia New Zealand (FSANZ) has issued a formal recall notice. AUSVEG has made contact with the grower impacted by the recall, as well as FSANZ and NSW Health in relation to this recall.

AUSVEG has been reassuring Australian consumers that they can have confidence in all other spinach and leafy salad products that are currently available for sale on retail shelves, which are unaffected by the recall.

AUSVEG will continue to liaise with all relevant authorities and key stakeholders as the issue unfolds, and will make further announcements if the issue escalates further.

Supply and Pricing

Coming into the last week before Christmas the concerns of shortages and increased vegetable prices is creating media attention and consumer interest.

The average price for all vegetables has actually declined to the lowest price we have seen in the last 12 months. This does follow a period of high pricing due to severe weather events and shortages that have been pushing prices up over the past 12 months. The total volume of vegetables has also increased, which is expected given we are entering the peak summer harvest period. The increased volume of supply also contributes to the decreased cost.

However, not all vegetables have followed this trend.

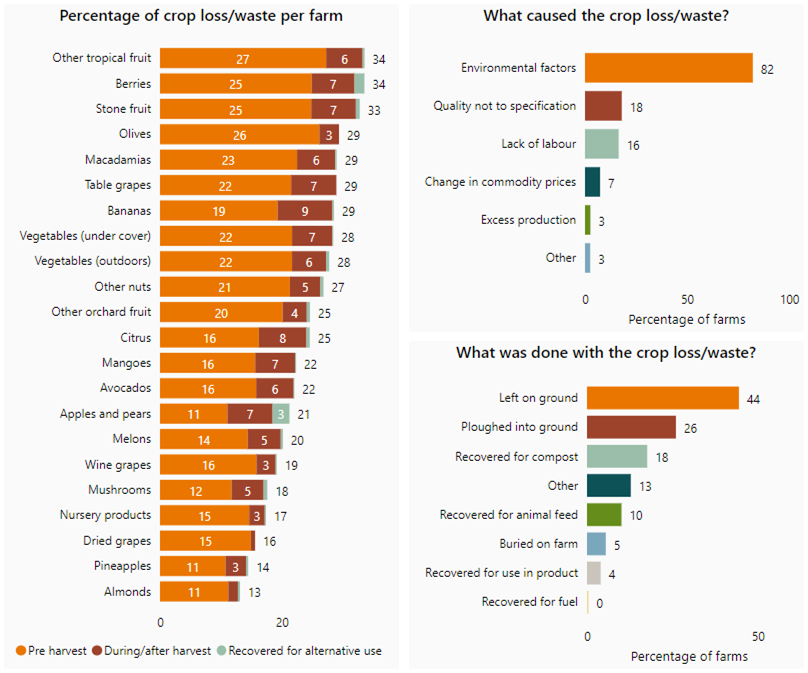

Due to the relentless flooding and rain, the soft ground has meant many growers have been unable to get crops in or out, leading to crop loss and waste (see Figure 1). One of the biggest impacts has been on potatoes. The flooding will cause shortages and high prices into 2023.

Potatoes are receiving the highest price the market has seen in over two years, and roughly 10,000 tonnes less production than there was this time last year.

Overall, there is weaker consumer demand for fresh produce as consumers look to cheaper options including frozen goods. The reduced domestic demand may impact 2023.

Figure 1. Crop loss/waste on Australian horticulture farms, 2021-22. ABARES

Around 17 per cent of Australian horticulture farms that experienced crop loss in 2021–22 reported that a lack of labour was one of the primary causes for the loss. However, most farms that lost crops in 2021–22 (82 per cent) indicated that environmental factors were the primary cause, with most of this loss occurring pre-harvest and largely outside of their control.

Inputs

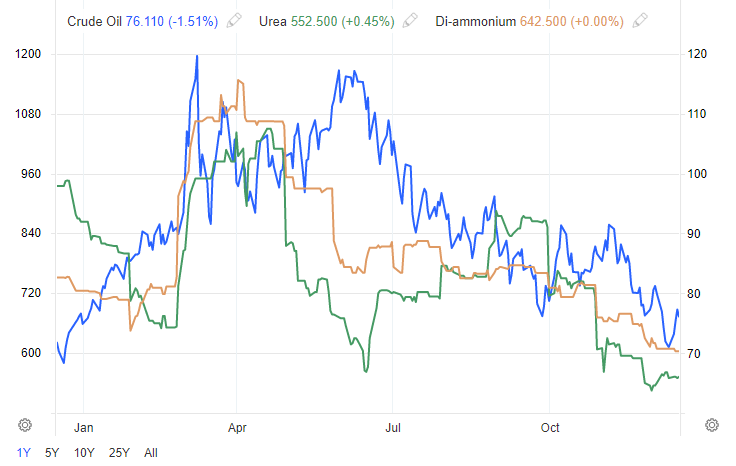

Since our last update on November 25, the price of some core inputs has been reduced, however they are still largely elevated since pre-2020 prices (see Figure 2).

From December 2020 to December 2022, Crude Oil has increased 23.6 per cent, Urea 127.8 per cent, and DAP 157.5 per cent.

Figure 2. Three core inputs in horticulture production.

Pallets

Who would have thought something so simple has the potential to be the undoing of the supply chain? The shortage could prevent the delivery of food, groceries, and medicines to retailers over the Christmas period.

At Christmas there are more goods moving around the country so the need for pallets increases. With increased goods moving around the country there is increased demand on the national pallet pool. Many pallets are not fit-for-purpose due to overuse and are taking too long to repair further reducing the pool.

This is yet another uncontrollable challenge growers face in getting their goods to market.

Industry has raised the alarm with the federal government, the ACCC, and the Office of Supply Chain Resilience in fear of the looming pallet shortages.

There is blame being cast on CHEP, the world’s largest pallet supplier, for failing to invest to increase pool of pallets, despite that demand has been rising for years. CHEP has said they have invested $100m to increase the pallet pool in Australia.

Stockpiling, timber shortages and prices have also added to the pallet shortage, compounded by a shortage of workers who also make and repair the pallets.

.

Workforce

The ABARES insights report has shown that among all the workforce shortages, horticulture production has increased. Around 40 per cent of growers brought in machinery to replace workers where possible, while others altered crop plantings for a longer peak harvest.

Another change growers made was to increase the hours worked by the existing workforce. ABARES said that “around 27% of Australian horticulture farms in 2021–22 had their employees working longer hours on average compared to previous years, with these farms employing 35% of the Australian horticulture workforce.”

Large horticulture farms experienced the greatest loss in labour over the last three years and also experienced the most difficulty recruiting workers. Permanent labour (excluding family members) decreased by 31 per cent (10,000 workers).

WHMs are returning!

As at 11 November 2022, over 106,000 working holiday makers have arrived in Australia since 15 December 2021 (the week the borders opened to fully vaccinated WHMs). There are currently 93,600 still onshore in Australia. Before the borders closed there were approximately 137,000 WHMs in Australia.

Since the border re-opening the Department has granted nearly 161,200 working holiday maker visas both onshore and offshore. There are nearly 73,500 WHMs offshore who are able to travel to Australia immediately. With winter encroaching on the northern hemisphere there is some evidence to suggest in recent weeks that WHM numbers are increasing. Should these visa holders not decide to come to Australia it is important to understand what the drivers were so that these can be addressed for the future.