The times they are a-changing: how Coronavirus has changed the world

The COVID-19 pandemic has changed most aspects of our lives – how we live, how we work and how we interact with our friends and family. But what has been made abundantly clear is the essential nature of the agriculture industry – particularly those who supply fresh vegetables. AUSVEG National Manager – Communications Shaun Lindhe takes a deep-dive into the pandemic and its wide-reaching impacts, plus the support that is being provided to vegetable growers.

When reports of the first case of Coronavirus (COVID-19) came to light towards the end of 2019, we didn’t truly understand the level of disruption that we would face in our day-to-day lives. At the time of writing in mid-May, over 4.1 million cases of COVID-19 had been reported, with the actual numbers likely to be much higher as the level of testing struggles to detect all of those who have it.

Sadly, there have been over 280,000 deaths around the world – again the number of actual deaths from COVID-19 is likely much higher as reported deaths do not cover all of those who have lost their lives from the virus, particularly in developing countries that lack the adequate resources and tests to track those with COVID-19. Australia has fared better than most other countries in the developed world, particularly compared to the U.S.A. and many European countries.

By mid-May, Australia had just over 6,900 confirmed cases and around 100 deaths. The National Cabinet, which comprises the prime minister and all state and territory premiers and chief ministers, regularly convened to coordinate messages to the Australian public and to ensure adequate measures were implemented in all states and territories in line with expert advice to protect the health and well-being of the public.

Messages highlighting the importance of good hygiene and maintaining safe social distances were communicated widely to the public, and the strictest shutdown measures in recent memory were put in place across the country to stop the spread of the virus.

To address the biggest economic challenge facing Australia this decade, the state and federal governments adopted the country’s most significant stimulus packages to help the economy survive, totalling over $300 billion across all states and territories. Public gatherings were banned. Planes were grounded. Schools shut their doors. Businesses shut up shop. Over 300,000 jobs were lost and over 200,000 positions were stood down. But people still needed to eat – and the agriculture sector and supply chain, including hard-working vegetable and potato growers, kept on working to keep people in jobs and to help families keep food on the table.

Impact on businesses and growers, families and workers

Industry and government at all levels were quick to recognise the importance of farmers and the supply chain in feeding the country. The industry and its supply chain was quickly acknowledged as an essential service, which allowed the industry to stay in operation during the COVID-19 pandemic and gave it confidence that the assistance that was required to support the industry would be provided. But while the agriculture sector has continued to operate, the impact of COVID-19 has been extraordinary.

The disruption of the food service industry, the uncertainty of the domestic retail landscape, the logistical impediments to exports and the challenges in adapting business workforce and operation plans to adhere to social distancing measures have all affected the costs of production, the returns to the farmgate and the overall economic performance and confidence of most farming operations.

There have been reports of growers being forced to plough fresh produce and considering reducing planting for the next crop due to the pandemic. Speaking to the Nine newspapers, AUSVEG CEO James Whiteside noted that while some businesses are doing okay, a lot of people – particularly those that were either accessing food service markets or were selling highly perishable produce – have seen their markets disappear.

“It’s uncharted territory for just everybody in the whole economy. It certainly is for farmers – and the upshot of all this is that Australians are eating less healthily,” James said.

“The message to consumers is, if you want to look after yourself, you need to be thinking about fresh produce.”

Added to the on-farm challenges, the personal toll on farmers, business owners, workers and families and friends cannot be understated. While many farmers are well-versed in isolation given the nature of the work, being unable to see friends and family has impacted everyone in some way. Local sporting clubs have closed, which many people rely on for their social outlets and sense of community. This has a flow-on effect to regional and rural towns, many of which have lost vital shows and events that bring much-needed tourism and money to businesses and communities – not to mention the hope and joy that comes with seeing fresh faces around town.

Calculating the financial and personal impact on farmers, regional communities is nigh impossible. However, industry and government have worked tirelessly to keep agriculture alive and to mitigate the impact of COVID-19 on farmers, their workers, their families and their communities.

Ensuring growers have enough workers

Once the consequences of the travel bans and social distancing restrictions became clear, AUSVEG worked with the broader industry to lobby government to ensure that the issues that were facing vegetable growers were addressed. Initially, this focused on ensuring there were enough workers to get vegetables from the farm to the consumer. AUSVEG worked with the Australian Fresh Produce Alliance (AFPA) to map the labour requirements for the horticulture industry over the short-, medium- and long-term, including identifying how many workers are required in specific regions. This work was important for temporarily extending vital foreign agriculture and food processing workers in early April.

The changes allow those within the Pacific Labour Scheme, Seasonal Worker Program and Working Holiday Maker program to continue to work in agriculture and food processing until the coronavirus crisis has passed. The visa extensions are a sensible and practical solution for fruit and vegetable growers who rely on a combination of local workers and foreign backpackers to work on farms to supply Australian with ample fruits and vegetables.

“The decision to temporarily extend the visas of seasonal workers and backpackers already working on farms in Australia will give growers confidence to plant their crops for the coming season, will help keep local businesses open in regional and rural areas that rely on agriculture to survive, and will ensure that locals, seasonal workers and backpackers alike are able to keep their jobs, work and live safely, and keep the economy running,” James said.

“This was an important outcome for the Australian horticulture industry and demonstrates the value in the sector coming together and collectively advocating on behalf of fruit and vegetable growers towards an outcome that benefits growers, workers and the Australian public.”

AUSVEG has aided the wider industry’s response to the pandemic through its work on the National Farmers Federation (NFF) Horticulture Council, seconding its National Manager – Public Affairs as the Council’s Executive Officer to ensure that horticulture-wide issues are dealt with. The NFF’s Horticulture Council is now entering its third year and has developed into an effective pathway to raise and advocate issues on behalf of the horticulture industry.

As a result of that, membership of the council has continued to grow which is a positive sign of the industry coming together on common issues. AUSVEG is closely monitoring the industry’s labour situation and has been working with the National Farmers Federation (NFF) Horticulture Council, AFPA and the broader industry to ensure growers continue to have a reliable and adequate workforce.

Getting exports off the ground

The forced grounding of most domestic and international air travel resulted in an immediate challenge to exporters, particularly vegetable exporters who transported high value, perishable product as belly cargo in aeroplanes.

To address this, the government announced a $110 million International Freight Assistance Mechanism (IFAM) to help allow Australia’s vegetable grower exporters to meet the demand from key international markets for high-quality fresh vegetables. This initiative is an interim emergency mechanism to both assist industry with keeping access to export markets that some businesses have built over many years, and also an opportunity to showcase Australian agriculture and enhance our reputation as a reliable supplier in both good times and bad.

A network of 15 air freight service providers and freight forwarders has been established by the government to accelerate delivery of agricultural and fisheries exports into key overseas markets. AUSVEG has been in regular contact with government on behalf of growers and provided detailed data to the IFAM coordination team on the footprint of fresh vegetable airfreight exports – by city of origin, export market destination, crop/product and volume by month, to ensure vegetable exporters can use the mechanism to continuing exporting their products.

AUSVEG National Manager – Export Development Michael Coote said that IFAM was an important step to help ensure local growers do not lose the markets that they have worked hard to maintain over many years.

“Demand has continued to be strong for Australian fresh vegetables in international markets, with enquiries still coming in from a range of key importers. While demand has been high, exports of fresh vegetables have been affected by the reduction in the number of commercial passenger flights, which many growers use to export their fresh, perishable products to key Asian and Middle Eastern markets,” Michael said.

“Australian vegetables have a strong reputation for quality and reliability in key export markets, so it is critical that we are able to continue to export our fresh produce and that vegetable growers have a commercially-viable avenue to reach these markets.”

“We have been working closely with the Austrade team administering the IFAM, including Michael Byrne as the International Freight Coordinator General, to help exporting vegetable growers to continue to export their fresh vegetables to international markets.”

At the time of writing, air freight prices remain relatively high and capacity in the air freight network is down around 70 per cent on pre-COVID levels. These two issues have made in challenging for fresh produce exporters to get their products on planes to continue servicing international customers.

Impact on different sectors of the industry

The ongoing COVID-19 pandemic has caused a seismic shift in the domestic supply chain, with the true extent of the impact becoming clearer the longer the pandemic lasts.

Overall impact

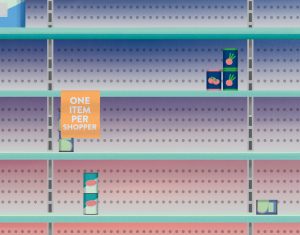

According to a Nielsen report, composed for the Hort Innovation-funded Harvest to Home project, in the four weeks to 22 March 2020 there have been unprecedented grocery sales in the wake of COVID-19. In the reporting period, total grocery sales were 18.0 per cent higher than Christmas month 2019; driven by increases in frequency and spend per trip. Produce also had the highest four weekly volume growth, mainly driven by vegetable sales.

“Shoppers have rushed to stockpile on packaged groceries to prepare for lockdown at home and in response to fear of scarcity on supermarket shelves, though bulk purchasing of fresh produce was not quite as pronounced,” Nielsen Associate Director – Fresh Industry Lead and the report’s author, Melanie Norris, said.

“The monthly volume growth of fresh produce reached a two-year high, up 5.1 per cent during the four weeks ending 22 March. During this time, promotional activity was cancelled by many retailers to manage demand, while higher pricing caused by supply chain interruptions due to bushfires and drought were also in play.”

According to the report, vegetables were the key driver of strong fresh produce performance, increasing by 15 per cent in the reporting period.

Potatoes, carrots and onions – all vegetables that store well – contributed most to the growth.

“Households purchased vegetables more frequently, on average, and increased their volume per shopping trip,” Melanie said.

“In other parts of the store vegetables were also in high demand, with frozen sales up by 59.8 per cent, while sales of canned vegetables increased by 118.5 per cent.”

Conversely, fruit volume sales declined in the same period. Bananas, apples and stonefruit were the highest contributors to volume growth; however, berries, avocados and citrus did not perform as expected during the last four weeks, perhaps due to the shorter shelf life and more discretionary nature of berries and avocados in particular.

For fruit in other parts of the store, frozen fruit recorded an all-time high for volume growth of 39.3 per cent, while canned fruit also increased by 73.9 per cent, suggesting that longevity was a key consideration. Given that the average price of fruit was 7.9 per cent higher than the same time year ago, budgetary constraints may also have factored in here.

Impact on wholesale

Central markets operate as a market and clearing house for produce, with prices based on supply and demand. The customer supply chain of central market wholesalers is expansive and includes independent and major supermarkets, greengrocers, processors, exporters, secondary wholesalers, providores serving the foodservice sector and weekend markets.

Fresh Markets Australia (FMA) is the national organisation representing each of the five Market Chambers across Australia. FMA Executive Officer Gail Woods says that the sudden change in consumer sentiment at the onset of the pandemic resulted in a much higher-than-normal demand at the retail level, which in turn caused businesses that operated at the central wholesale markets to also experience a high level of demand.

“The Australian consumer’s initial response to the pandemic has been well documented in relation to panic buying,” Gail says.

“Initially, retailers experienced a very high level of demand across all commodities, but particularly hard produce. The increase in home cooking had seen good consumer demand for produce generally on top of seasonal demand.”

Conversely, the abrupt and almost complete closure of the food and beverage sector has had a dramatic negative impact on the demand for sector-specific produce, resulting in an over-supply of those commodities.

“While a number of suppliers to the sector were able to pivot to the consumer market, there was an overall negative impact on these suppliers,” Gail says.

“This produce destined for the food and beverage sector increased the supply to other supply chain customers.”

Despite the turmoil from the pandemic, there have been some issues affecting businesses in the industry that are unrelated to COVID-19.

“Not unlike other years, the environment for the 12 months prior to the pandemic saw the horticulture industry experience the supply of some commodities negatively impacted by droughts, floods and bushfires, while other commodity groups experienced good and even oversupply,” Gail says.

“Some wholesalers also reported some reduced or halted supply of produce due to growers’ labour shortages, resulting in crops not being able to be harvested.”

That being said, despite the severe disruption from the pandemic, there have been some positives for the supply chain through this time.

“The good working relationships between wholesalers and growers – some decades long – have continued with the good flow of information in relation to the changing demand and supply,” Gail says.

“The diversity of central markets supply chain customers means that produce can be marketed widely and not exclusively to one sector.”

“Wholesalers have displayed resilience, knowing how to adapt to environmental and economic challenges as proven over many years, and continue to operate, as fluctuations in supply and demand are commonplace in the supply chain.”

Impact on food service

The impact on the food service sector has been significant, with the only option for those offering dining out is to operate through pick-up, drive-thru and home delivery. This has resulted in a sizeable food distribution channel undergoing significant disruption.

The latest Hort Innovation-funded Hort Stats Handbook, produced by specialist food market researcher and analyst Freshlogic, quantifies the value of the horticulture food service market at $1.76 billion in 2018/19 from 687,600 tonnes of produce, with vegetables making up around 60 per cent at $1.05 billion and 438,000 tonnes.

Freshlogic Managing Director Martin Kneebone says that the COVID-19 pandemic has changed the way that people shop and these changes are expected to shape a ‘new normal’ of household food buyer behaviour in the medium-term.

“In current conditions consumers are no longer time-poor and have used this time to engage in cooking from scratch. In this mode, people also have a propensity to buy a wider range of produce than they usually would and then spend more time preparing a more involved meal,” Martin said.

“Households are expected to be more measured with their household spending as the economic effects of the COVID-19 pandemic continue, which may be reflected in lower demand for dining out, even after the restrictions are relaxed.”

“We expect consumers to be more conscious of portion sizes, as they are more likely to shop less frequently and buy more with each shop.”

“While consumers will look harder at the value of what they are buying, in these conditions food retailers can benefit. This is because purchasing higher value household items will be deferred and consumers shopping for food are prone to treat themselves.”

“The industry has added a lot of value by servicing time-poor consumers with products that have suited ‘top-up shopping’ several times a week and easy meal preparation. The new normal is still taking shape and has some way to go with the economic impacts are still arriving, but we expect it is unlikely things will switch back to completely to the way things were pre-COVID-19.”

Impact on processors

While the demand for frozen and canned products has increased in recent months, the impact on the processing industry, particularly for potatoes, has been immediate and significant. Anne Ramsay, Executive Officer of the Potato Processors Association of Australia, says that the impact has been felt differently across the processing sector.

“Crisping factories have stepped up to meet demand from their main clients – the supermarket and corner shop consumers,” Anne said.

“On the flip side, the French fry sector has seen a rapid decline in demand, as the volume of their market goes to the food service industries: pubs, clubs and restaurants. The combination of closures to dining-in options and the postponement of large sporting events, as well as an overall reduced demand from caterers, has resulted in a significant demand slump.”

“Australian French fry factories are looking to honour contracted obligations, while juggling supply and demand with freezer space.”

The outlook for the processing industry, like most, will be contingent on the duration of restrictions.

“The medium-term impact on the French fry industry is largely dependent on when isolation measures are scaled down, the level of disposable income available to consumers when the restrictions are softened, and changes in consumer behaviour as a result of the pandemic,” Anne said.

“Should restrictions continue to be in place into June and July, the outlook for the French fry industry will be longer felt.”

There may also be broader trends in the global market that could impact the performance of Australian processing companies, with a potential for international processors to dump product onto the Australian market.

“Many European-based factories are sitting idle or with reduced throughput, meaning large volumes of unprocessed product sits in storage,” Anne said.

“This may have a significant impact on the global French fry supply chain. The closure of some factories may see a reduction in supply out of Europe, although it is more likely that they will try to dump their produce below cost into the Australian market.”

“A move that will help counter possible international food dumping is a focus to become more self-reliant as a nation, with a demand for local produce with a transparent and reliable supply chain.”

Impact on supply chain

Boomaroo

For companies throughout the supply chain, their fortunes are often dependent on their customers’ supply chains.

For Boomaroo Nurseries, one of the country’s largest commercial vegetable seedling nurseries operating along the eastern seaboard, the greatest disruption has been some of the self-imposed preventative measures it has put into place to maintain continuity of supply and protect its workforce.

According to Boomaroo Nurseries Director, Nick Jacometti, the pandemic has also helped the business become more agile and tech-savvy.

“COVID-19 has forced us to communicate differently between our team members, as well as with our customers and supply chain partners,” Nick said.

“While the use of digital tools should never entirely replace face-to-face communication, the immediate need has encouraged us to use technology in ways that we were hesitant to use in the past. For example, it has certainly brought about efficiencies through reduced travel and enabled us to act more responsively.”

While there are many uncertainties as to what the ‘new normal’ may be post-COVID-19, Nick is confident that the industry is resilient enough to work through any challenges that come up.

“Thankfully as primary producers most of our customers are still experiencing reasonable demand for the vegetables they produce,” Nick said.

“The bigger concern for many is that they will not get the raw materials they need to keep farming. This concern is particularly heightened for products that are sourced from outside Australia.”

“Our customers are a tough bunch and they have experienced, survived and, in some instances, are still working through many challenges such as drought and floods. COVID-19 is undoubtedly a massive challenge for all, but the resilience and resolve of the Australian farmer is helping many get through.”

Fertiliser – Incitec Pivot Fertilisers

Other sectors of the supply chain were experiencing changes even before COVID-19 – particularly due to increased demand for product from higher-than-usual rainfall across eastern Australia.

Incitec Pivot Fertilisers (IPF) is Australia’s largest manufacturer and distributor of fertiliser, and is doing everything it can to supply fertilisers to farmers and support them to make the most of favourable planting conditions.

“Strong rainfall across eastern Australian has led to heightened demand for fertilisers during 2020 and our supply and distribution teams are working tirelessly with dealers and customers to deliver the products,” IPF VP Agronomy & Innovation Charlie Walker said.

“Due to the COVID-19 pandemic, IPF has implemented additional protocols to protect our workforce and customers, and ensure we are able to continue safely and responsibly supplying the essential fertilisers and agronomy services that underpin Australian food production.”

“All contracted fertiliser volumes are currently working their way through our supply chain. Our distribution centres are working as flexibly as possible to ensure a smooth and safe pick up process, and farmers should work with their dealers to schedule and pick up fertilisers in an orderly fashion.”

“We are encouraging farmers who are yet to contract their required fertiliser to engage their dealers and lodge orders as soon as possible.”

What is industry doing to increase domestic consumption?

Fruit & Vegetable Consortium

AUSVEG, Nutrition Australia and other industry groups have teamed up to launch the Fruit & Vegetable Consortium, which brings together key organisations to collectively advocate for comprehensive action to address Australia’s complacency about eating fruits and vegetables. Australians fall alarmingly short of the recommended daily intake, with just seven per cent of Australian adults and five per cent of children meeting the recommended guideline for daily vegetable intake.

The Fruit & Vegetable Consortium is collaborating to investigate options to increase fruit and vegetable consumption, including one project to develop a behaviour change program that will work to increase vegetable consumption among Australians to improve their health and well-being. More information on the Fruit & Vegetable Consortium’s efforts can be found here.

Growcom – Eat Yourself to Health

AUSVEG State Member Growcom has launched a new national campaign, Eat Yourself to Health, encouraging Australians to ‘Eat Up and Branch Out’ to boost fruit, vegetable and nut consumption. As part of the Eat Yourself to Health campaign, individual growers will be challenging consumers to their own unique COVID Cooking Challenge, encouraging creativity in the kitchen with fresh produce — while highlighting how the product’s nutrients and vitamins can boost one’s immune system. A website has been established with a variety of resources and information for consumers, including ready-made social media graphics, on how to boost their health through increased intake of fruits, vegetables and nuts.

Growers are encouraged to get involved and join the conversation today via on Facebook and Instagram at @eatyourselftohealthau or by using the hashtag #EatYourselfToHealth.

Hort Innovation – Good Mood Food

In response to COVID-19, Hort Innovation – the research and development corporation for Australian horticulture – has launched the Good Mood Food campaign, a new direct-to-consumer marketing campaign it hopes will invigorate consumer purchasing habits for fruit, vegetables and nuts both during and beyond the COVID-19 pandemic.

Taking a whole-of-horticulture approach, Hort Innovation aims to educate Australian consumers on the ways fruit, vegetables and nuts can be used to promote health and wellbeing.

Adopting the motto ‘The Good Mood Food’, the campaign will focus on mental health and wellbeing as Australians continue to adhere to social isolation rules. The message will be broadcast across television, print, radio, online via social media and through retail partnerships. It will run through September, with the possibility of it being extended beyond that time frame. More information on this campaign can be found here.

This article first appeared in the winter 2020 edition of Vegetables Australia. Click here to read the full publication.